December 11, 2008

GM'S COMMITMENT TO THE AMERICAN PEOPLE

Photo: Team Chevy NASCAR driver Kevin Harvick takes the Chevrolet Equinox Fuel Cell vehicle for a test drive after being shown its General Motors advanced technology Friday, August 29, 2008 in Fontana, California. (General Motors News Photo) (United States)

Photo: Chevrolet Volt Director of Design Bob Boniface (left) shows off the Chevrolet Volt to media as the vehicle makes its West Coast debut at the Los Angeles Auto Show in Los Angeles, California Wednesday, November 19, 2008. The Volt delivers up to 40 miles of gasoline and emissions-free electric driving with the extended-range capability of hundreds of additional miles. (General Motors News Photo) (United States)

Following is GM's letter published in Automotive News :

GM'S COMMITMENT TO THE AMERICAN PEOPLE

"We deeply appreciate the Congress considering General Motors' request to borrow up to $18 billion from the United States. We want to be sure the American people know why we need it, what we'll do with it and how it will make GM viable for the long term.

For a century, we have been serving your personal mobility needs, providing American jobs and serving local communities. We have been the U.S. sales leader for 76 consecutive years. Of the 250 million cars and trucks on U.S. roads today, more than 66 million are GM brands -- nearly 44 million more than Toyota brands. Our goal is to continue to fulfill your aspirations and exceed your expectations.

While we're still the U.S. sales leader, we acknowledge we have disappointed you. At times we violated your trust by letting our quality fall below industry standards and our designs become lackluster. We have proliferated our brands and dealer network to the point where we lost adequate focus on our core U.S. market. We also biased our product mix toward pick-up trucks and SUVs. And, we made commitments to compensation plans that have proven to be unsustainable in today's globally competitive industry. We have paid dearly for these decisions, learned from them and are working hard to correct them by restructuring our U.S. business to be viable for the long term.

Today, we have substantially overcome our quality gap; our newest designs like the Chevrolet Malibu and Cadillac CTS are widely heralded for their appeal; our new products are nearly all cars and "crossovers" rather than pick-ups and SUVs; our factories have greatly improved productivity and our labor agreements are much more competitive. We are also driven to lead in fuel economy, with more hybrid models for sale and biofuel-capable vehicles on the road than any other manufacturer, and determined to reinvent the automobile with products like the Chevrolet Volt extended-range electric vehicle and breakthrough technology like hydrogen fuel cells.

Until recent events, we felt the actions we'd been taking positioned us for a bright future. Just a year ago, after we reached transformational agreements with our unions, industry analysts were forecasting a positive GM turnaround. We had adequate cash on hand to continue our restructuring even under relatively conservative industry sales volume assumptions. Unfortunately, along with all Americans, we were hit by a "perfect storm." Over the past year we have all faced volatile energy prices, the collapse of the U.S. housing market, failing financial institutions, a stock market crash and the complete freezing of credit. We are in the midst of the worst economic crisis since the Great Depression. Just like you, we have been severely impacted by events outside our control. U.S. auto industry sales have fallen to their lowest per capita rate in half a century. Despite moving quickly to reduce our planned spending by over $20 billion, GM finds itself precariously and frighteningly close to running out of cash.

This is why we need to borrow money from U.S. taxpayers. If we run out of cash, we will be unable to pay our bills, sustain our operations and invest in advanced technology. A collapse of GM and the domestic auto industry will accelerate the downward spiral of an already anemic U.S. economy. This will be devastating to all Americans, not just GM stakeholders, because it would put millions of jobs at risk and deepen our recession. By lending GM money, you will provide us with a financial bridge until the U.S. economy and auto sales return to modestly healthy levels. This will allow us to keep operating and complete our restructuring.

We submitted a plan to Congress Dec. 2, 2008, detailing our commitments to ensure our viability, strengthen our competitiveness, and deliver energy-efficient products. Specifically, we are committed to:

• produce automobiles you want to buy and are excited to own

• lead the reinvention of the automobile based on promising new technology

• focus on our core brands to consistently deliver on their promises

• streamline our dealer network to ensure the best sales and service

• ensure sacrifices are shared by all GM stakeholders

• meet appropriate standards for executive pay and corporate governance

• work with our unions to quickly realize competitive wages and benefits

• reduce U.S. dependence on imported oil

• protect our environment

• pay you back the entire loan with appropriate oversight and returns

These actions, combined with a modest rebound of the U.S. economy, should allow us to begin repaying you in 2011.

In summary, our plan is designed to provide a secure return on your investment in GM's future. We accept the conditions of your loan, the commitments of our plan, and the results needed to transform our business for long-term success. We will contribute to strengthening U.S. energy and environmental security. We will contribute to America's technical and manufacturing know-how and create high quality jobs for the "new economy." And, we will continue to deliver personal mobility freedom to Americans using the most advanced transportation solutions. We are proud of our century of contribution to U.S. prosperity and look forward to making an equally meaningful contribution during our next 100 years."

"GM's foregoing appeal to the U.S. taxpayers leaves a negative impression on the shareholders and on the Investors-in-Waiting -- the key players that matter the most. The appeal makes no sense to them. They are looking for any tangible positive catalysis at GM.

If General Motors Corporation emboldens the shareholders and the Investors-in-Waiting by any courageous rational move, that would enable it to pull itself through."

© GlobalGiants.Com

"G.M. said it planned to focus on four core brands -- Chevrolet, Cadillac, Buick and GMC -- and sell, eliminate or consolidate the Saturn, Saab, Hummer and Pontiac brands.

Despite having downsized its operations in the last three years, G.M. said it would cut more than 20 percent of its remaining jobs, shut nine factories, seek to renegotiate the terms of $66 billion in debt, and push to reopen contract talks with the United Automobile Workers to reduce labor costs."

-- Article in The New York Times

"Bankruptcy, whether it's structured or not, would destroy demand for that company's vehicles and put dealers out of business."

-- Annette Sykora, Chairman of the National Automobile Dealers Association

"The terms of the loans will require auto companies to demonstrate how they would become viable. They must pay back all their loans to the government, and show that their firms can earn a profit and achieve a positive net worth. This restructuring will require meaningful concessions from all involved in the auto industry -- management, labor unions, creditors, bondholders, dealers, and suppliers.

In particular, automakers must meet conditions that experts agree are necessary for long-term viability -- including putting their retirement plans on a sustainable footing, persuading bondholders to convert their debt into capital the companies need to address immediate financial shortfalls, and making their compensation competitive with foreign automakers who have major operations in the United States. If a company fails to come up with a viable plan by March 31st, it will be required to repay its federal loans.

The automakers and unions must understand what is at stake, and make hard decisions necessary to reform. These conditions send a clear message to everyone involved in the future of American automakers: The time to make the hard decisions to become viable is now -- or the only option will be bankruptcy."

-- President George W. Bush on the administration's plan to assist U.S. auto makers. December 19, 2008.

Edited & Posted by Editor | 2:55 AM | Link to this Post

December 2, 2008

Ford Motor Company Will Re-Evaluate Its Strategic Options for Volvo Car Corporation

Ford Motor Company has just announced in Dearborn, Michigan that it will re-evaluate strategic options for Volvo Car Corporation, including the possible sale of the Sweden-based premium automaker.

Ford said the decision to re-evaluate strategic options for Volvo comes in response to the significant decline in the global auto industry particularly in the past three months and the severe economic instability worldwide. The strategic review of Volvo is in line with a broad range of actions Ford is taking to strengthen its balance sheet and ensure it has the resources to implement its product-led transformation plan.

"Given the unprecedented external challenges facing Ford and the entire industry, it is prudent for Ford to evaluate options for Volvo as we implement our ONE Ford plan," said Ford President and CEO Alan Mulally. "Volvo is a strong global brand with a proud heritage of safety and environmental responsibility and has launched an aggressive plan to right-size its operations and improve its financial results. As we conduct this review, we are committed to making the best decision for both Ford and Volvo going forward."

Ford said the review likely will take several months to complete. In the meantime, Ford will continue working closely with Volvo as it implements its restructuring plan under CEO Stephen Odell, who was appointed to lead Volvo earlier this year.

Photos: Volvo XC60

"Outstanding safety, an increased focus on environmentally friendly vehicles and contemporary Scandinavian design will continue to be the foundation upon which we will build a strong Volvo business for the future." Volvo CEO Stephen Odell said. "We intend to build upon our strong brand heritage and to appeal to our global customers with vehicles like the new XC60 -- the safest car Volvo has ever built. Volvo also will introduce seven low-emission models in 2009, giving us the best environmental product range in the premium segment. We have a strong brand presence in Europe, North America and the Asia Pacific region, and are growing in key markets such as China and Russia, where we are the leading premium brand."

Ford Motor Company's core and affiliated automotive brands include Ford, Lincoln, Mercury, Volvo and Mazda.

"It is an interest that is important to our economy, to our industrial base, the workforce concerns that are important to our country. We want to be able to review the performance of the auto companies as we go forward. In order to do that, it is important for us to pass legislation that will set criteria for restructuring and reorganization of that industry and the companies within it.

It is important to note that unless the restructuring that is called for in this legislation and the goal of viability is achieved by March 31, there is no justification for spending any more taxpayer dollars. Now it has been said this is a loan of $15 billion because it's for a different purpose than under Section 136; 136 is for innovation...

But come March 31, it is our hope that there will be a viable automotive industry in our country with transparency and accountability to the taxpayer. We think that is possible...

But if they don't meet the conditions of restructuring, there is not going to be an endless flow of money to this industry, left to their own devices and the practices they have engaged in.

So we will see how willing everyone is to go into the future, but we want to recognize the importance of the automotive industry to our country. Their survival is essential to our economy. If they cannot survive, then we have to make a re-evaluation of the leadership as well, because we will not give up on our automotive industry. It's just a question of how it is manifested and how it is led.

I am very encouraged by the conversations so far. We are on the path. I will only support using Section 136 with the assurance that we will get it back in a number of weeks. And in fact, in a number of weeks, if the Big Three are not on the path to viability, we may want our money back sooner than March 31 instead of over the longer term that would be built into the bill should they again be a thriving, competitive, innovative auto industry for the future."

-- Nancy Pelosi, Speaker of the United States House of Representatives. December 8, 2008

"Running a multi-billion-dollar automobile company with thousands of employees, retirees, suppliers, dealers and communities counting on you is not for the weak of heart or for the timid or the untried. Especially the untried.

Having been there, I do not agree with the sentiment now coming out of Congress that the management should be changed as a condition of granting loans to the Detroit automakers. You don't change coaches in the middle of a game, especially when things are so volatile. The industry has been brutalized by a totally unpredictable series of events over which it had little control and that is beating it unmercifully into the ground.

The companies may not be perfect but the guys who are running them now are the only ones with the experience and the in-depth knowledge and understanding of how the car business really works. They're by far the best shot we have for success. I say give them their marching orders and then let them march. They're the right people to get the job done."

-- Lee Iacocca, Former Chairman and CEO of Chrysler and Former President of Ford Motor Company, on Auto Industry Loans. Los Angeles, December 9, 2008.

|GlobalGiants.com|

Edited & Posted by Editor | 11:13 AM | Link to this Post

November 17, 2008

The Cost of GM's Death: Automotive News's Warning to the US Federal Government

Acquainting the U.S. federal government with "The Cost of GM's Death", Crain Communications's automotive industry tabloid newsweekly 'Automotive News' has issued the following statement:

If Congress thinks a bailout of General Motors is expensive, it should consider the cost of a GM failure.

If Congress thinks a bailout of General Motors is expensive, it should consider the cost of a GM failure.

Let's be clear. The alternative to government cash for GM is not a dreamy Chapter 11 filing, a reorganization that puts dealers and the UAW in their place, ensuring future success.

No, even if GM could get debtor-in-possession financing to keep the lights on (which it can't), Chapter 11 means a collapse of sales and a spiral into a Chapter 7 liquidation.

GM's 100,000 American jobs will die. Health care for a million Americans will be lost or at risk. Hundreds of GM's 1,300 suppliers will die. Their collapse could take down Ford Motor Co. and Chrysler LLC, perhaps even North American transplants. Dealers in every county of America will close.

The government will face greater unemployment, more Americans without health insurance and greater pension liabilities.

Criticize Detroit 3 executives all you want. But the issue today is not whether GM should have closed Buick years ago, been tougher with the UAW or supported higher fuel economy standards.

In the next two to four months, GM will run out of cash and turn out the lights. Only government money can prevent that. Every other alternative is fantasy.

The $25 billion in loans that Congress approved to partially fund improvements in fuel economy? Irrelevant. Dead automakers do not invest in technology.

The collapse of the global financial system has crushed the American car market, dried up revenues for the Detroit 3 and highlighted their weaknesses.

Each of the Detroit 3 is in crisis. But Ford, which borrowed big two years ago and thus has more cash today, may skip a bailout and the strings attached. Cerberus, which bought Chrysler last year, doesn't deserve money. Government cash might help sell Chrysler to a strategic owner.

Some Detroit critics want their pound of flesh: Throw the bums out and install a government czar. Treasury Secretary Henry Paulson won't use any of his $700 billion bank bailout money to help manufacturers. In any case, he'd need a guarantee that a bailout would make Detroit "viable."

Well, nobody -- not even AIG -- is insuring guarantees for viability.

The taxpayer needs protection and an upside. GM's top management may need to go. Government-as-shareholder deserves a big voice. Those details can be worked out.

The Detroit 3 CEOs and UAW President Ron Gettelfinger had better tell two critical congressional hearings next week what sacrifices they are prepared to make.

But the stark fact remains: Absent a bailout, GM dies, and with it much of manufacturing in America. Congress needs to do the right thing -- now.

Source: Automotive News

"From the sublime to the ridiculous there is but one step."

-- Napoleon Bonaparte

"We saw how the Japanese auto companies changed their business practices and were able to stay competitive. We had about 25 years or so to try to deal with this, and we didn't. Now it looks like the reckoning is coming.

My heart says, 'yes,' to the federal loan because of the phenomenal ripple effect throughout the economy if Congress doesn't do it, especially in the Midwest. [The leaders of General Motors, Ford and Chrysler are pleading with Congress for a $25 billion loan as a bailout to the auto industry to prevent bankruptcy.]

But my head says, 'no,' because I don't have a lot of faith the government can intervene and fix this without much more money going in to what would be a bottomless pit, particularly with the hubris of the Big 3 leadership over the past 50 years.

The proposed loan would just be a 'Band-Aid'. All they'd be doing is buying time, perhaps through 2010 when the union contract ends or for the release of the Chevy Volt and other planned hybrid cars.

We'd be starting to see America more like a colonial economy, no longer the primary owners of what we make, and we'd see more of the wealth go overseas."

-- John Heitmann, Automotive Historian and Expert, University of Dayton

"Notwithstanding the criticism of its management, General Motors Corporation must remain intact. Americans must remember that for the last many years, the words 'General Motors' and 'Chevrolet' have been synonymous with the word USA, and have been their brand ambassadors worldwide.

The issue of 'GM's Bailout' is not merely an issue concerning domestic finance, commerce, industry, or economy. It is much more than that. It is an issue of America's honor, goodwill, and credibility in the international business."

© GlobalGiants.Com

|GlobalGiants.com|

Edited & Posted by Editor | 1:35 AM | Link to this Post

November 16, 2008

Global Association of Risk Professionals Provides Financial Risk Manager Certification Exams to Nearly 14,000 Candidates Around the World

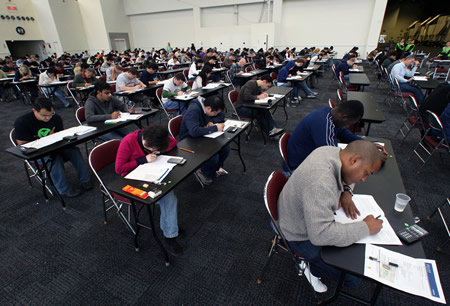

Photo: In New York's Jacob K. Javits Convention Center, November 15, several hundred financial risk manager certification candidates taking the 6-hour Financial Risk Manager (FRM(R)) Exam offered by the Global Association of Risk Professionals (GARP).

Yesterday, on November 15, at 9 am local time in each of 78 cities around the world, a record-breaking total 13,681 financial professionals were registered to take the annual Financial Risk Manager (FRM(R)) certification exam offered by the Global Association of Risk Professionals. From New York to Hong Kong, the 6-hour exams were taken at testing centers located in major cities across six continents including Mumbai, Beijing, Jakarta, Tokyo, Singapore, Seoul, Bangkok, London, Paris, Warsaw, Frankfurt, Istanbul, Dublin, Stockholm, Tel Aviv, Dubai, Melbourne, Sydney, Johannesburg, Montreal, Toronto, Dallas, Seattle, Honolulu and many others.

The Global Association of Risk Professionals (GARP) is a not-for-profit independent association of close to 100,000 risk management practitioners and researchers representing banks, investment management firms, government agencies, academic institutions, and corporations from more than 167 countries worldwide.

There were 500 candidates registered to take the exam in New York, 1,700 in Hong Kong and 1,100 in Mumbai, reflecting the significant and growing global attention to the practice of financial risk management," said Richard Apostolik, GARP President and CEO. "FRM certification has become the gold standard for financial risk managers to objectively demonstrate real world competence in their profession, and the FRM certification program is helping to expand industry-wide understanding of financial risk management best practices, concepts and theories," he added.

|GlobalGiants.com|

Edited & Posted by Editor | 2:40 AM | Link to this Post

October 4, 2008

Realtors, Accountants Applaud House Passage of Financial Stability Bill

"The National Association of Realtors(R) is truly relieved that members of the U.S. House of Representatives, like their counterparts in the Senate, were able to come together in a bipartisan effort to pass the Emergency Economic Stability Act of 2008. As we have been saying, this legislation is critical to stopping the economic turmoil that millions of Americans are facing. Today's action will go a long way toward ending the current economic crisis crippling the housing and financial markets.

This legislation would quickly restore liquidity to the mortgage market, which would stabilize the housing market and protect homeowners. Mortgages as well as personal and small business loans would become more available and less costly. Protecting Main Street not only benefits individuals, families and communities, but also supports the larger U.S. economy.

We expect that the president will act quickly to sign and enact this bill. We thank President Bush for his steadfast leadership on this issue, commend all parties that worked on this legislation, and look forward to working together toward a strengthened economy for the benefit of all Americans."

- Richard F. Gaylord, President, National Association of Realtors. [National Association of Realtors, 430 North Michigan Avenue, Chicago, IL 60611, USA.]

"The House of Representatives' historic vote demonstrated leadership in difficult times. Americans and businesses, small and large, are already suffering financial challenges as a result of this crisis. This legislation is the first step in restoring liquidity in our economy. CPAs will roll-up our sleeves to do our part to help individuals and businesses move forward. The profession has already been actively reaching out through extensive financial literacy efforts to help Americans cope with the personal financial challenges they face.

The AICPA is pleased Congress avoided calls by some for an immediate suspension of fair value accounting rules. The bill includes a call for an objective study of mark-to-market accounting. We look forward to participating with the Securities and Exchange Commission and the Financial Accounting Standards Board in a thoughtful review.

Accounting standards are the keystone of our financial reporting system and are designed to provide investors and management with timely signals about the financial condition of our publicly-traded companies. Our longstanding position is that accounting standards ultimately should be set by the private sector."

- Barry Melancon, President, American Institute of Certified Public Accountants (AICPA). [HQ: AICPA, 1211 Avenue of the Americas, New York, NY 10036, USA. The American Institute of Certified Public Accountants is the national, professional association of CPAs, with more than 350,000 CPA members in business and industry, public practice, government, education, student affiliates, and international associates. It sets ethical standards for the profession and U.S. auditing standards for audits of private companies, non-profit organizations, federal, state and local governments. It develops and grades the Uniform CPA Examination.]

|GlobalGiants.com|

Edited & Posted by Editor | 12:50 PM | Link to this Post

September 29, 2008

U.S. Government Rescue Plan Praised by Franchise Industry

The International Franchise Association (IFA) today applauded the bipartisan economic rescue plan agreed to by congressional leaders and urged both the House and Senate to pass it quickly. The International Franchise Association is the world's oldest and largest organization representing franchising.

"We support the plan as outlined today by negotiators as a critical step in freeing up needed credit to help keep Main Street businesses operating and growing," said IFA Vice President of government relations David French. "Our members commend the extraordinary efforts by leading policymakers over the weekend to bring this important legislation together. The addition of crucial oversight and taxpayer safeguards strengthens the plan, and the package should send a positive signal to the financial markets and bring stability to the U.S financial system."

The franchised business sector is made up of locally owned businesses that create 21 million jobs and contribute $2.3 trillion to the private sector economy. Thousands of IFA members made their views known to congressional leaders this weekend with the message to come together on a bipartisan plan to bring stability to our nation's financial markets.

"We are grateful that our views and the views of thousands of small businesses across the country were heard," French said. "Now, Congress should pass the bill quickly and get it to the President for signing."

• Other Voices:

"Workers will not accept their tax dollars being turned over to the fat cats who took multi-million dollar bonuses and then bankrupted their companies and now threaten our entire economy. Action on the bailout will shape the votes of working Americans in November."

- Anna Burger, Chairperson, Change to Win. [Change to Win, 1900 L Street, NW Suite 900, Washington, DC 20036, USA, is one of the largest organizations of working Americans.]

"This massive bailout is nothing short of a scheme by irresponsible corporate pirates to privatize gains and socialize debt. Such a move will only further add to the burden of individuals and families, who are already struggling to make ends meet. Not one of our tax dollars should go toward rescuing an industry that is failing because of unregulated lending and trading practices.

We are tired of giving golden parachutes to greedy corporate interests. We're standing up and saying, 'Not this time, not with my money and not with my consent'."

- Cindy Sheehan, Candidate for Congress.

"Proposed $700 Billion Bailout Is Too Little, Too Late to End the Debt Crisis; Too Much, Too Soon for the U.S. Bond Market: The proposal before Congress for a $700 billion financial industry bailout will not only fail to end the massive U.S. debt crisis but could actually aggravate the crisis by driving up interest rates.

Based on recently released FDIC and Federal Reserve data, Weiss Research finds that:

1. 1,479 U.S. banks and 158 U.S. thrifts are at risk of failure, with total assets of $3.2 trillion, or 41 times the assets of banks on the FDIC's list of troubled institutions.

2. Among those with $5 billion or more in assets, 61 banks and 25 thrifts are heavily exposed to nonperforming mortgages.

3. The bailouts announced and proposed to date, although expected to cost over $1 trillion, are too small to rescue most institutions at risk, let alone address multiple problems with U.S. interest-bearing debts outstanding of $51 trillion and derivatives held by U.S. banks of $180 trillion.

There should be no illusion that the $700 billion estimate proposed by the Administration will be enough to end the crisis. Nor should there be any false hopes that the market for U.S. government securities can absorb the additional burden of a $700 billion bailout without putting major upward pressure on U.S. interest rates, aggravating the very debt crisis that the government is seeking to alleviate."

- Weiss Research, Inc. [Weiss Research, Inc., 15430 Endeavour Drive, Jupiter, FL 33478, USA.]

"Members of Congress are being asked to come together in a bipartisan effort to deal with an unprecedented financial crisis that threatens the stability of the global economy. For good reason, many are reluctant to take abrupt and dramatic action without giving due consideration to the long-term implications. This caution and thoroughness is appropriate. But it does not diminish the need to take convincing action very soon.

• There will be a time for investigation and the assessment of blame and guilt. This is not it.

• There will be a time to re-balance the powers of the executive and legislative branches of government. This is not it.

• There will be time to ensure government is not intruding unimpeded into the realm of private markets. This is not it.

The objections of lawmakers and many in the public to news of the "bailout" on the grounds of political philosophy and legislative oversight, and pure fear of government growth are legitimate and worthy. But the urgency of the situation -- the possibility of economic chaos and all that would mean -- is also legitimate.

What the economy requires immediately is first aid -- not long-term care. A first responder deals with the "ABCs" -- "airway, breathing and circulation." The same triage is required for the global economy. We are choking on bad debt and in real danger of the complete loss of financial circulation. We have to get the economy breathing again and world markets circulating freely. Then we can deal with everything else.

We do not have the leisure to stand over the victim arguing about who is to blame for the injury or who is going to pay for the treatment. That must come after we know the victim will live."

- Pennsylvania Business Council. [Pennsylvania Business Council, 116 Pine Street, Suite 201, Harrisburg, Pennsylvania 17101, USA.]

"It's fine to hope for the best, but we should budget for the worst. While the intent of this plan is to recoup much, if not all, of the initial cost to taxpayers there are no guarantees. The value of the assets to be purchased is highly uncertain. What we know for certain is that the government will incur a huge upfront cost, immediately adding to the debt and immediately incurring compounding interest payments. All of this will be layered on top of a deficit expected to exceed $500 billion next year, and an overall fiscal policy that is unsustainable. Meanwhile, we are borrowing increasing amounts from abroad to make up for our inability to make crucial budgetary decisions. The answer to every problem in Washington seems to be more debt. That simply cannot go on. Given the uncertainty of the return on this $700 billion of new borrowing, and the daunting challenges already confronting the fiscal outlook, Congress should adjust budget policy either though phased-in spending cuts or tax increases to ensure against any permanent fiscal deterioration.

Washington can normally act in the face of a crisis. We don't need to relearn that lesson. A more fundamental issue is whether we can learn from the current crisis and finally break the pattern of routinely ignoring long festering problems. It is no secret that our nation is entering an unprecedented and permanent demographic transformation to an older society and that we are doing so with steadily rising health care costs and steadily falling national savings. This is a dangerous combination for the future health of the economy. And yet, nothing in the budget process requires Congress to review the current-law outlook beyond the next five years, much less take corrective action. If we learn from Wall Street's mistakes, we can act more effectively, with less pain, and more time to prepare the public for difficult but necessary choices. If we don't change course, the federal government itself will be in need of a bailout."

- Robert L. Bixby, Executive Director, The Concord Coalition. [The Concord Coalition, 1011 Arlington Blvd., Suite 300, Arlington, VA 22209, USA.]

"As you know, about a week and a half ago, the Administration visited Capitol Hill and described the crisis in our financial markets and in our economy. A couple of days later, they presented us with their legislation, and since then we have worked in a bipartisan way to improve that legislation. We've entered into those conversations in the spirit of bipartisanship, with the understanding that each side would have half of our votes to pass the bill.

Today when the legislation came to the floor, the Democratic side more than lived up to its side of the bargain. While the legislation may have failed, the crisis is still with us.

Some of the issues that we worked on with the Republicans to improve the initial legislation related to oversight and protecting the taxpayer as we stabilize the markets. It was about ownership and equity in return for some of the investments that were made. It was about forbearance for homeowners so they could stay in their home. It was about corporate pay and how that had no more golden parachutes, and it was also about, again, oversight, oversight, oversight. I think these were major improvements to the bill, and as I say, they were bipartisan.

Again, the Administration pressed upon us the seriousness of this crisis in terms of the markets. We know how serious this is in terms of the middle class in our country. Whether it's a question of credit for small businesses or homeowners, for protecting savings for people, their penchants for retirement, for the education of their children. Keeping the store on the corner open to service the needs of the people in the neighborhood. America's communities have been feeling the downturn in the economy for a very long time...

The President impressed the Members about the gravity of the situation; that action is necessary to stabilize the markets and to protect the taxpayer.

Clearly, that message has not been received yet by the Republican Caucus. But again, we extend a hand of cooperation to the White House, to the Republicans, so that we can get this issue resolved for the benefit of America's working families, to strengthen our economy, and therefore strengthen our country...

So again, the legislation has failed but the crisis has not gone away. We must work in a bipartisan way, in order to have another bite of the apple, in terms of some legislation."

- Nancy Pelosi, Speaker of the House of Representatives, after the House rejected the Bailout Package 228-205 on Monday, September 29, 2008.

"September 29, 2008

TO THE MEMBERS OF THE UNITED STATES CONGRESS:

The U.S. Chamber of Commerce, the world's largest business federation representing more than three million businesses and organizations of every size, sector, and region, urges Congress to immediately pass the bipartisan financial rescue package to stem the financial panic. Congress must not adjourn without taking action to stabilize the financial markets.

Today's failure to approve legislation addressing the financial crisis has resulted in uncertainty and turmoil that have dramatically affected the markets, and lowered equity prices, eroding individual savings and destroying billions of dollars of household wealth.

Make no mistake: when the aftermath of Congressional inaction becomes clear, Americans will not tolerate those who stood by and let the calamity happen. If, on the other hand, Congress supports a plan to successfully restore the financial system and preserve the flow of credit to the economy, the American people will recognize that act of courage.

The Chamber urges Congress to immediately pass financial rescue legislation. The Chamber will score votes on, or in relation to, this issue in our annual How They Voted scorecard.

Sincerely,

R. Bruce Josten"

- U.S. Chamber of Commerce. [U.S. Chamber of Commerce, 1615 H St NW, Washington DC 20062, USA.]

"Over the last decade, U.S. Chamber of Commerce has spearheaded and accelerated the movement for less corporate accountability and less regulation. During this same time period, there have been major corporate fraud convictions, accounting scandals, and the biggest economic crisis since the Great Depression at a great cost to the American people.

The current financial crisis was caused by U.S. Chamber's aggressive lobbying to eliminate accountability and oversight. Today, U.S. Chamber is the loudest supporter of a $700 billion taxpayer bailout, even though it spent the last decade fighting to eliminate corporate accountability -- one of the major factors that led to the current financial crisis.

U.S. Chamber has been paid millions by large corporations to limit the rights of shareholders, roll back Sarbanes-Oxley reforms, prevent disclosures to investors, and protect boardrooms while preventing consumers from holding them accountable.

U.S. Chamber of Commerce has sought to destroy any check on corporate excess, accountability and greed. By conducting the dirty work of Enron, Exxon, AIG, and a host of other negligent corporations, U.S. Chamber has put countless Americans in financial jeopardy."

- American Association for Justice. [American Association for Justice, 777 6th Street, NW, Washington, DC 20001, USA (formerly known as the Association of Trial Lawyers of America), is the world's largest trial bar.]

"On behalf of our ten member companies representing nearly 80% of the U.S. new car sales market, the Alliance of Automobile Manufacturers strongly urges Congress and the Administration to come together swiftly to stabilize the credit market.

• For many Americans, after their homes, automobiles are the largest purchase they will ever make.

• With more than 90% of all new vehicles financed with credit it is crucial to our industry's survival that consumers have the ability to borrow money.

• This financial crisis not only compromises the vitality of our companies but also, and more importantly, the one in ten Americans whose jobs are supported by the auto industry, including suppliers, dealers and small businesses. Immediate action is imperative.

• We commend the bipartisan leadership of Congress and the Administration for their efforts to craft a compromise and urge Congress to quickly pass, by the end of this week, a financial rescue package that aids both the credit markets and the ability of consumers to finance vehicle purchases."

- Dave McCurdy, President and CEO, Alliance of Automobile Manufacturers. [The Alliance of Automobile Manufacturers is a trade association of 10 car and light truck manufacturers including • BMW Group, • Chrysler LLC, • Ford Motor Company, • General Motors, • Mazda, • Mercedes-Benz USA, • Mitsubishi Motors, • Porsche, • Toyota and • Volkswagen. Formed in 1999, the Alliance serves as a leading advocacy group for the automobile industry on a range of public policy issues.]

|GlobalGiants.com|

Edited & Posted by Editor | 10:21 PM | Link to this Post

September 17, 2008

Bank of America becomes Financial Services Global Giant as it Buys Merrill Lynch

Bank of America Corporation's announcement that it has agreed to acquire Merrill Lynch & Co., Inc. in a $50 billion all-stock transaction, has created a company unrivalled in its breadth of financial services and global reach. While Bank of America is one of the world's largest financial institutions, Merrill Lynch is one of the world's leading wealth management, capital markets and advisory companies, with offices in 40 countries and territories. As an investment bank, it is a leading global trader and underwriter of securities and derivatives across a broad range of asset classes and serves as a strategic advisor to corporations, governments, institutions and individuals worldwide.

"Acquiring one of the premier wealth management, capital markets, and advisory companies is a great opportunity for our shareholders," Bank of America Chairman and Chief Executive Officer Ken Lewis said. "Together, our companies are more valuable because of the synergies in our businesses."

"Merrill Lynch is a great global franchise and I look forward to working with Ken Lewis and our senior management teams to create what will be the leading financial institution in the world with the combination of these two firms," said John Thain, chairman and CEO of Merrill Lynch.

The transaction is expected to close in the first quarter of 2009. It has been approved by directors of both companies and is subject to shareholder votes at both companies and standard regulatory approvals. Under the agreement, three directors of Merrill Lynch will join the Bank of America Board of Directors. By adding Merrill Lynch's more than 16,000 financial advisers, Bank of America would have the largest brokerage in the world with more than 20,000 advisers and $2.5 trillion in client assets.

At the same time, the sale of Merrill Lynch (MER) to Bank of America (BAC) has triggered one of the largest and most historical talent feeding frenzies in recent history.

"We have received a lot of calls from Merrill FAs already," says Darin Manis, CEO of RJ & Makay a national financial recruiting firm. "Once the dust settles Merrill brokers will be waiting to hear what their retention packages will be."

RJ & Makay is a financial recruiting firm that has recruited many dozens of brokers representing billions in assets this year and hopes to capitalize on the turbulent landscape to grab billions more in the fourth quarter.

"Even if the pending announcement of the retention package is competitive there will still be attrition. Historically there is an average pattern of 8%-15% attrition. With Merrill's size that could mean over 2,000 brokers ending up with a Merrill competitor. With the average Merrill FA having about 100 million in assets this is clearly a unique and welcome recruiting opportunity," Manis adds.

"Merrill Lynch and Lehman Brothers are the latest corporate casualties in the financial crisis caused by abusive loans from reckless lenders. Even the former chair of the Mortgage Bankers Association now concedes that brokers, lenders and investors 'forgot about [their] customers' because 'making money and our commission checks were more important.' In short, these loans never should have been made. The failure of Lehman and forced sale of Merrill underscore the need for stronger regulation of the mortgage market to prevent this from recurring, and, if we want to fix the economy, the need to modify the millions of bad loans that created this mess."

- Center for Responsible Lending, Sep 15, 2008. [Center for Responsible Lending, 302 West Main Street, Durham, NC 27701, USA.]

"Lehman Brothers aside, the government's actions toward Bear Stearns, Fannie and Freddie, and now handout requests from Detroit automakers could signal an ominous new trend of meddling in markets. Politicians have been digging taxpayers deeper into the fiscal hole, and we have to take their shovels away before we're all buried for good."

- Pete Sepp, Vice President for Policy & Communications, National Taxpayers Union (NTU), Sep 16, 2008. [National Taxpayers Union, 108 N. Alfred Street, Alexandria, Virginia 22314, USA.]

|GlobalGiants.com|

Edited & Posted by Editor | 1:47 AM | Link to this Post

August 28, 2008

Shanghai World Financial Center Opens to the Public

Photo: Journalists enjoy a spectacular bird's eye view across Shanghai from the observatory deck on the 100th floor of Shanghai World Financial Centre. The observatory deck, the highest in the world, offers sweeping vistas right across the city and features a special 50m-long glass floor that provides a unique perspective on the city, and the thriving district of Pudong below. It opens to the public on August 30th, 2008.

Photo: Mr. Minoru Mori (middle in the front), President and CEO of Mori Building, shows a scale model to the VIPs at the opening press conference of this landmark building. Shanghai World Financial Centre measures 492 meters and boasts 101 floors. Mr. Minoru Mori described the building as a "global magnet for finance, information and talent".

Edited & Posted by Editor | 10:02 AM | Link to this Post

June 21, 2008

U.S. Olympic Team Advertising Campaign by Bank of America

Advertising celebrates America's strong voice of support for Team USA.

Bank of America, the Official Bank Sponsor of the 2008 U.S. Olympic Team, has announced the debut of its U.S. Olympic-themed advertising campaign.

The multimedia campaign rallies support for Team USA(TM) through the company's signature Olympic-themed programs -- America's Cheer(TM) and U.S. Olympic Team Banking -- and includes a new national television commercial, as well as print, radio, online and point-of-sale advertisements.

"Unlike any other sporting event in the world, the Olympic Games are the only time when an entire nation cheers for one team," said Anne Saunders, Brand and Advertising executive, Bank of America. "Our new campaign captures the passion and spirit with which Americans everywhere are cheering on the extraordinary athletes who will represent the United States at the 2008 Olympic Games."

Created by BBDO New York, the campaign features images of Americans showcasing their spirited expressions of patriotic support for Team USA, with a voiceover that enlists America to "cheer your head off with America's Cheer dot-com and the U.S. Olympic Team will hear you all the way to China."

In addition to America's Cheer, the new campaign promotes U.S. Olympic Team Banking only available at Bank of America. The suite of U.S. Olympic Team-branded checks and Visa(R) Check Cards and credit cards enable customers to support America's Olympic athletes with every purchase with their card, while earning special rewards.

Photo: An image from Bank of America's U.S. Olympic-Themed TV commercial.

Bank of America's new campaign makes its debut on June 21 in conjunction with NBC's coverage of the U.S. National Team Trials for Diving. Thereafter, the new campaign will continue to run leading up to and during NBC's national broadcast of the Beijing 2008 Olympic Games and on NBC affiliates around the country in Boston, Charlotte, Chicago, Los Angeles, Miami, New York, San Francisco and Washington D.C.

America's Cheer: America's Cheer is Bank of America's grassroots campaign that provides an opportunity for all Americans to cheer on the nation's finest athletes as they prepare to compete at the 2008 Olympic Games in Beijing, China. Whether it's an energetic video or audio recording, heartfelt letter or inspiring photo, America's Cheer invites the entire country to express their support for Team USA(TM) through the act of cheering.

Photo: Soccer Spectators looking at a Large TV Screen

To upload a cheer, individuals or groups can visit http://www.americascheer.com/. Cheers can also be recorded by visiting the America's Cheer(TM) mobile tour which is currently visiting 19 cities and 26 events, traveling 27,000 miles before its final stop in Detroit, Mich., on Aug. 24, 2008, a date that coincides with the Closing Ceremony of the 2008 Olympic Games.

U.S. Olympic Team Banking: In recognition of what the U.S. Olympic Team means to its customers, Bank of America has developed U.S. Olympic Team Banking, a new suite of Team USA-branded checks and Visa(R) Check Cards and credit cards that enables customers to support America's Olympic athletes with every purchase with their card, while earning special rewards for themselves. With every U.S. Olympic Team credit card purchase, customers can earn points to redeem WorldPoints(R) rewards for cash, airline tickets, hotel stays and for Bank of America U.S. Olympic Team merchandise, memorabilia and exclusive experiences. Customers can also generate contributions to the U.S. Olympic Team when they open a new U.S. Olympic Team checking account and with every U.S. Olympic Team Visa Check Card or credit card purchase at no additional cost to themselves. (One may visit http://www.bankofamerica.com/olympics to sign-up or to learn more about the many features and benefits of U.S. Olympic Team Banking.)

Bank of America's U.S. Olympic Team Sponsorship: Bank of America is widely recognized as a major corporate sponsor of the U.S. Olympic Team, creating opportunities for the nation's best athletes to represent the United States in world-class competition. Bank of America's earliest known involvement with the U.S. Olympic Movement dates back to 1921, when the bank provided leadership and financing for the Los Angeles Coliseum, site of the 1932 and 1984 Olympic Games. In 1992, Bank of America signed on as an official sponsor of the U.S. Olympic Team that competed in Barcelona, Spain, and has supported every U.S. Olympic Team since, including the American athletes who will compete in the 2008 Olympic Games in Beijing, China.

Bank of America is one of the world's largest financial institutions, serving individual consumers, small and middle market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk-management products and services. The company serves clients in more than 150 countries and has relationships with 99 percent of the U.S. Fortune 500 companies and 83 percent of the Fortune Global 500.

Source: Bank of America

|GlobalGiants.com|

Edited & Posted by Editor | 6:13 AM | Link to this Post

April 17, 2008

Thomson Reuters is Born: Unveils its New Branding and a Global Advertising Campaign

Photo: Thomas Glocer the new CEO of Thomson Reuters today unveiled its new branding and global advertising campaign across from multiple screens in Times Square, New York City. Mr. Glocer said, "The dynamic new corporate identity is a marked departure from the historical look and feel of the two companies and represents Thomson Reuters positioning as the world's leading source of intelligent information to businesses and professionals."

The Thomson Corporation has completed its acquisition of Reuters Group PLC, forming Thomson Reuters (NYSE: TRI; TSX: TRI; LSE: TRIL: NASDAQ: TRIN), the world's leading source of intelligent information for businesses and professionals in the financial, legal, tax and accounting, scientific, healthcare, and media markets.

At the same time, Thomson Reuters unveiled its new branding and a global advertising campaign. Mr. Thomas H. Glocer, chief executive officer of Thomson Reuters said, "The dynamic new corporate identity is a marked departure from the historical look and feel of the two companies and represents Thomson Reuters positioning as the world's leading source of intelligent information to businesses and professionals."

Thomson Reuters has more than 50,000 employees with operations in 93 countries on six continents and 2007 pro forma revenues of approximately US$12.4 billion.

Commenting on the just created Global Leadership Position of Thomson Reuters, Mr. Glocer said, "This is a very exciting day for our shareholders, customers and employees. Thomson Reuters will deliver the intelligent information needed to give businesses and professionals the knowledge to act. We call our information "intelligent" because it is not only insightful, highly relevant and timely, but it is also made available in formats which applications can consume and to which they can add further value. We are witnessing the maturation of the information economy and content from Thomson Reuters will be its currency." "Thomson Reuters will benefit from the value created by more diversified revenue streams, a larger capital base and synergies resulting from the acquisition. Our leadership position and global footprint will give us opportunities to grow faster than either Thomson or Reuters could have on its own," said Mr. Glocer.

On May 1, 2008, Thomson Reuters plans to announce results for the first quarter as well as a financial outlook for the remainder of 2008.

|GlobalGiants.com|

Edited & Posted by Editor | 11:04 AM | Link to this Post

March 31, 2008

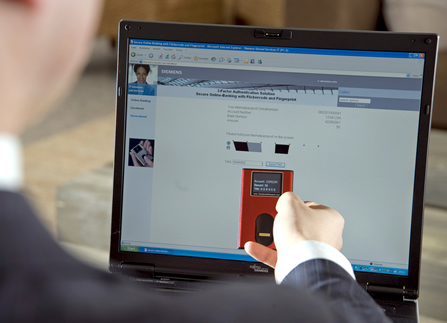

Be ready to get your Internet ID Card!

Siemens, in cooperation with a partner company, has developed an Internet ID card the size of an ATM card that enables users to provide authentication prior to a bank transaction. The device uses a fingerprint and an integrated key. The ID card doesn't require any additional software or hardware, so it is safe from attacks and can be used on any computer. The solution is slated for market launch in the summer of 2008. |GlobalGiants.com|

Edited & Posted by Editor | 1:05 PM | Link to this Post

March 29, 2008

SABEW 13th Annual Best in Business Journalism Contest Winners

![]()

Recognizing top publications and the best business news reporting during 2007, The Society of American Business Editors and Writers Inc. (SABEW), a not-for-profit organization made up of business journalists in North America, has announced the winners in its 13th annual Best in Business Contest. SABEW is headquartered at the Missouri School of Journalism at the University of Missouri-Columbia.

SABEW started the contest in 1995 to help set standards and recognize role models for outstanding business journalism. It has grown steadily since then. Categories for magazines and online sites were added this year. A record 842 entries were submitted for work in 2007 by daily newspapers, business weeklies, magazines, wire services and news Websites.

SABEW will hand out the awards during a ceremony at its annual conference, at 6 p.m. April 27 at The Sheraton Inner Harbor Hotel in Baltimore, Maryland.

Following is the full list of winners:

Overall Excellence

Giant Newspapers

(Average daily circulation above 325,000)

Arizona Republic

Los Angeles Times

The New York Times

USA Today

Certificates of Merit:

The Boston Globe

The Plain Dealer (Cleveland)

Large Newspapers

(circulation from 225,000 to 325,000)

The Miami Herald

Rocky Mountain News (Denver)

The Seattle Times

Certificates of Merit:

The Indianapolis Star

The Orange County Register

Detroit Free Press

Mid-sized Newspapers

(circulation from 125,000 to 224,999)

The Charlotte Observer

The Des Moines Register

The Detroit News

Grand RapidsPress

Seattle Post-Intelligencer

Certificates of Merit:

St. Paul Pioneer-Press

Salt Lake Tribune

Small newspapers

(circulation under 125,000)

Arizona Daily Star (Tucson, Ariz.)

The News Tribune (Tacoma, Wash.)

The Press Democrat (Santa Rosa, Calif.)

Certificates of Merit:

The Patriot Ledger (Quincy, Mass.)

The Post & Courier (Charleston, S.C.)

Weekly Business Newspapers

Advertising Age

Boston Business Journal

Crain's New York Business

Financial Week

Triangle Business Journal (Raleigh-Durham, N.C.)

Certificate of Merit:

Mass High Tech

Small Magazines

(circulation under 500,000)

Bloomberg Markets

Large Magazines

(circulation 500,000 and over)

Fast Company

Small Websites

(up to 500,000 average monthly unique visitors)

Wired.com

Certificate of Merit

Crain's Chicago Business

Mid-sized Websites

(500,000-2.5 million average monthly unique visitors)

AdAge.com

Certificate of Merit

Azstarbiz.com, Arizona Daily Star

Large Websites

(more than 2.5 million average monthly unique visitors)

MarketWatch

The New York Times Dealbook

The Wall Street Journal Online

Business News Reporting

Breaking News

Giant publications

• Patti Bond, Robert Luke, Tom Walker, Maria Saporta, Matt Kempner,

Marilyn Geewax, Duane D. Stanford, The Atlanta Journal-Constitution:

"Nardelli's departure from Home Depot"

• Krishna Guha, Michael Mackenzie, Saskia Scholtes and Gillian Tett, The

Financial Times: "Federal Reserve"

• Robin Sidel, Aaron Lucchetti, Monica Langley, Carrick Mollenkamp, David

Reilly and David Enrich, The Wall Street Journal: "The fall of a

Citigroup Prince"

Large publications

• Staff, Detroit Free Press: GM/UAW settlement

• Staff, Detroit Free Press: Pfizer breaking news

• Roger Fillion, Chris Walsh, David Milstead, Charles Chamberlin,

Joyzelle Davis, Rob Reuteman and Jane Hoback, Rocky Mountain News:

Coors-Miller merger

Mid-sized Publications

• Stella M. Hopkins, Adam Bell, Gail Smith-Arrants, Sharif Durhams,

Christopher D. Kirkpatrick, Tommy Tomlinson, Kat Greene, Marion

Paynter, Mark Johnson and David Ingram, The Charlotte Observer: "Philip

Morris quits North Carolina"

• Amos Maki, Commercial Appeal (Memphis.): "Toyota's decision"

• Sharon Terlep, Bruce G. Hoffman, Eric Morath, Christine Tierney, Daniel

Howes, Louis Aguilar, Nathan Hurst, Brian J. O'Connor, Josee Valcourt

and Bill Vlasic, The Detroit News: "UAW strike"

Small Publications

• Jack Gillum, Christie Smythe and David Wichner, Arizona Daily Star:

"First Magnus meltdown"

• Kathy Jumper, George Talbot, Russ Henderson, Sebastion Kitchen, Dan

Murtaugh, Kaija Wilkinson and Jeff Amy, Press-Register (Mobile, Ala.):

"Towering triumphs"

• Carol Benfell, The Press Democrat (Santa Rosa, Calif.): "Hospital

closure"

Weekly Publications

• Brent Snavely, Crain's Detroit Business: "Icahn on Lear: company

positioned well in industry"

• Andrew Osterland, Marine Cole, Matthew Quinn, Nicholas Rummell and

Frank Byrt, Financial Week: "Credit crunch"

Real-time News Organizations

• Scott Lanman, Brendan Murray, Matthew Brockett, Caroline Salas, Anthony

Massucci, Lynn Thomasson and Shannon Harrington, Bloomberg News:

"Bernanke's world unravels"

• John D. Stoll and Stephen Wisnefski, Dow Jones News Service:

"DaimlerChrysler stock moves into high gear"

Enterprise

Giant Publications

• David Barboza, The New York Times: "A Chinese reformer betrays his

cause, and pays"

• Gretchen Morgenson, The New York Times: "Crisis looms in mortgages"

• Kate Kelly, The Wall Street Journal: "Bear CEO's handling of crisis

raises issues"

Large Publications

• Jeffrey Tomich, St. Louis Post-Dispatch: "Bet the farm"

• Pete Carey, San Jose Mercury News: "Harsh side of the boom"

• Kristi Heim, The Seattle Times: "China's eco-city"

Mid-sized Publications

• Rick Rothacker and David Ingram, The Charlotte Observer: "Is this a

conflict?"

• Sharon Terlep and Bill Vlasic, The Detroit News: "Inside story"

• Rebecca Mowbray, New Orleans Times-Picayune: "Same house. Same repairs.

Same insurer. Why different prices?"

Small Publications

• Becky Pallack, Arizona Daily Star: "First Magnus: Boom to bust in three

weeks"

• Dan Kelley, Corpus Christi Caller-Times: "Is the city growing or

stretching?"

• George Talbot, Press-Register (Mobile, Ala.): "Several factors are key

to deal"

Weekly Publications

• Ron Leuty, San Francisco Business Times: "The fight of his life: Bay

Area tech execs and VCs rally to aid one of their own battling a rare

disease"

• Daniel Kaplan and Mark Mensheha, Street & Smith's SportBusiness

Journal: "American invasion: What's driving the gold rush to English

soccer?"

• Dan Monk and Tom Demeropolous, Business Courier of Cincinnati: "Dark

side of progress: The transformation of UC has taken more of a

financial toll than many in the campus community realize"

Real-time News Organizations

• John Schoen, MSNBC: "Mortgage mess"

• John Lippert, Bloomberg News: "Fall of Detroit"

• Melissa Davis, TheStreet.com: "Shattered hopes"

Columns

Giant Publications

• David Leonhardt, The New York Times

• Joseph Nocera, The New York Times

• Michelle Singletary, The Washington Post

Large Publications

• Eileen Ambrose, The Baltimore Sun

• Mary Jo Feldstein, St. Louis Post-Dispatch

• Al Lewis, The Denver Post

Mid-sized Publications

• Mitchell Schnurman, Fort Worth Star-Telegram

• George Gombossy, The Hartford Courant

• Liz Benston, Las Vegas Sun

Small Publications

• Gregory Karp, The Morning Call (Allentown, Pa.)

• Dan Voelpel, The News-Tribune (Tacoma, Wash.)

• Susan Miller, Ledger-Enquirer (Columbus, Ga.)

Weekly Publications

• Brian Kaberline, Kansas City Business Journal

• Greg David, Crain's New York Business

• Steve Symanovich, San Francisco Business Times

Real-time News Organizations

• Jon Markman, MSN Money

• James Saft, Reuters

• Brett Arends, TheStreet.com

Projects

Giant Publications

• Patricia Callahan, Maurice Possley, Michael Oneal, Evan Osnos, Ted

Gregory and Sam Roe, Chicago Tribune: "Hidden hazards"

• Charles Duhigg, The New York Times: "Golden opportunities"

• Walt Bogdanich, The New York Times: "Toxic pipeline"

Large Publications

• Suzanne Rust, Meg Kissinger and Cary Spivak, Milwaukee Journal

Sentinel: "Chemical fallout"

• Mike Casey and Rick Montgomery, Kansas City Star: "Fatal failures"

• Gargi Chakrabarty, Rocky Mountain News: "Ethanol boom: Kernel to car"

Mid-sized Publications

• Binyamin Appelbaum, Lisa Hammersly, Ted Mellnik, Peter St. Onge, Stella

M. Hopkins, Liz Chandler, Mike Drummond, Pam Kelley, Gary Schwab and

Patrick Scott, The Charlotte Observer: "Sold a nightmare"

• Lee Rood, Lynn Hicks, Philip Brasher, Paula Lavigne, Jerry Perkins,

Perry Beeman, Jon Benedict, Jeff Bruner, Suzanne Behnke and Don Tormey,

Des Moines Register: "Fueling Iowa's future"

• Christine Tierney and Bill Vlasic: The Detroit News: "Death of a

Merger"

Small Publications

• Winston Ross, The Register-Guard (Eugene, Ore.): "Big fish in a big

pond"

• Richard M. Hogan, Fort Myers (Fla.) News-Press: "Southwest Florida real

estate sellers beware"

• James L. Martin, Erie (Pa.) Times-News: "Made in Mexico"

Weekly Publications

• Bryant Ruiz Switzky, Katharine Grayson, Nancy Kuehn, Eric Johnson and

Dirk DeYoung, The Minneapolis- St. Paul Business Journal: "Operation

reintegration"

• Jeanne Lang Jones and Steve Wilhelm, Puget Sound Business Journal:

"Industrial land"

• Christopher Tritto, The St. Louis Business Journal: "Fig"

Real-time News Organizations

• David Dietz, Gary Cohn and Darrell Preston, Bloomberg News: "The

insurance hoax"

Magazine Cover Stories

Large Magazines

• Brian Grow and Keith Epstein, Business Week: "The poverty business"

• Ellen McGirt, Fast Company: "Al Gore's $100 million makeover"

Small Magazines

• David Evans, Richard Tomlinson, Seth Lubove and Daniel Taub, Bloomberg

Markets: "Toxic debt"

Online Excellence

Breaking News

Large Websites

• Tom Krazit, Caroline McCarthy, Erica Ogg, Kent German, Leslie Katz,

Brian Cooley, CNET News: "Launch of the iPhone"

• Staff, CNNMoney.com: "Turmoil in the mortgage and credit markets"

Small Websites

• Steve Daniels, Senior Reporter, Crain's Chicago Business: "LaSalle's

Richman near deal to join private bank"

• Alby Gallun, Reporter, Crain's Chicago Business: "Kennedy, developer

plan big Wolf Point project."

• Chad Eric Watt, Staff Writer; Dave Moore, Staff Writer, Dallas Business

Journal: "Questions dog press club"

Projects

Large Websites

• Rex Nutting, Amy Hoak and Alistair Barr, Marketwatch: "Subprime

shakedown: Will 'lemming loans' drive economy off cliff?"

• Art Lenehan, Anh Ly, Suzanne McGee and Chris Oster, MSN Money: "Keeping

up with the Wangs"

• David Barboza, Keith Bradsher, Howard French, Joseph Kahn, Jim Yardley

and the staff of The New York Times and nytimes.com: "Choking on

growth: China's environmental crisis"

Mid-sized Websites

• Ted Mellnik, Bill Pitzer, Phillip Hoffman, David Enna, The Charlotte

Observer: "Sold a nightmare"

Small Websites

Certificate of Merit

• Rich Laden, Nichole Montanez, Mark Reis, Christian Murdock, David

Bitton and Joanna Bean, The Gazette (Colorado Springs): "Academy

Boulevard at a crossroads"

Audio/Visual Reports

Large Websites

• John Authers, Financial Times: "Short view"

• Jenalia Moreno and Brett Coomer, Houston Chronicle: "Olive oil"

• David Pogue, The New York Times: "The iPhone challenge: keep it quiet"

Mid-sized Websites

• Hoag Levins, Ad Age: "3-Minute Ad Age"

• Stephanie AuWerter and Stacey Bradford, SmartMoney.com: "Smart Advice

video: avoiding foreclosure"

Blogs

Large Websites

• Dwight Silverman, Houston Chronicle: "Techblog"

• Staff, The New York Times: "Bits"

• Staff, The Wall Street Journal: "Deal Journal"

Mid-sized Websites

• Bill Bowen, Jim Fuquay, Dianna Hunt, Mike Lee, Richard Stubbe and Scott

Nishimura, Fort Worth Star-Telegram: "Barnett Shale: Drilling for

answers about the natural gas boom in North Texas"

• Jonathan Lansner, Orange County Register: "Lansner on real estate"

• Todd Bishop, Seattle Post-Intelligencer: "Todd Bishop's Microsoft Blog"

Creative Use of Online

Large Websites

• Roben Farzad, Business Week: Narrated slideshows

• Staff, MarketWatch: "The heat is on"

• Staff, CNNMoney.com: "2007 best places to live"

Student Contest

For stories written for professional publications

• Daniel Johnson, Seattle Times: "Grape-growing town not on wine lovers'

map"

For stories written for student publications

• Jessica Nunez, Columbia Missourian: "Funding farming"

Source: The Society of American Business Editors and Writers

|GlobalGiants.com|

Edited & Posted by Editor | 3:01 PM | Link to this Post

January 25, 2008

American College President authors new book on scandals -- Crisis Leadership Now

Today's European Trading Scandal Highlights Need for Crisis Planning on Corporate Agenda

Just made announcement by European investment banker Societe Generale that a single employee allegedly committed a $7 billion case of trading fraud points to the need for employers to heighten safeguards against internal and external threats, according to a recently released book by the President of The American College.

"Stock option backdating, subprime losses and credit card theft represent market exposures that raise questions about Board governance and internal controls," notes Laurence Barton, Ph.D. "Where were the auditors? Who has accountability and where is the outcry," he notes.

Barton, a widely quoted analyst and professor at The College who is the former vice president of crisis management for Motorola worldwide noted: "Crisis management is more than safety awareness - what can companies do to prevent all kinds of threats, from workplace violence to structural failures and product recalls? We are witnessing a profound lack of quality assuredness in management oversight that extends across industries."

His new book, Crisis Leadership Now, was released by McGraw-Hill. In the book, Barton analyzes more than 400 scandals that impacted notable companies including jetBlue, Marsh, Virginia Tech, Hewlett-Packard and British Petroleum. He found that a lack of crisis auditing on risk exposures often contributes to a problem blossoming into an organizational crisis that can affect the financial condition, brand and recruiting power of an organization.

Photo: Societe Generale Loses $7 Billion to Fraudulent Trader: The Bank of France said on Thursday it would open an inquiry into a fraud at French bank Societe Generale which could have a 4.9 billion euros (3.7 billion pounds) negative impact on the group.

"Society Generale's credibility and potentially its future is on the line today," he adds. "A recommended roadmap is to admit to a profound lack of controls, the absence of detailed, daily oversight and the need for transparency. Offers of executive resignations are not enough. Winning back the confidence of the investment community requires a massive organizational commitment to detailed accounting forensics by external parties," he adds.

"You cannot rely solely on your insurance company to bail you out," Barton notes. "Senior executives must own risk and crisis planning, assess the preparedness of their human resources, security and legal teams to harness solutions quickly when a risk emerges, and they must be flawless at communicating real-time," he adds. "Whether it's Virginia Tech, a mall shooting or a product recall, we still come back to basics: What did you know? When did you know it? What did you do about it?" he asks. |GlobalGiants.com|

Source: The American College

Edited & Posted by Editor | 7:57 AM | Link to this Post

December 15, 2007

Daimler Financial Services Americas: New Headquarters

Photo: Klaus Entenmann, President and CEO of Daimler Financial Services Americas, presents a check for $100,000 to a surprised Susan Goodell, Executive Director of Forgotten Harvest. Joyce Jennarou, a Forgotten Harvest board member, looks on.

Daimler Financial Services Americas, which is comprised of Mercedes-Benz Financial and Daimler Truck Financial, reinforced its commitment to the Southeast Michigan region today. In addition to keeping the company headquarters here as a result of the DaimlerChrysler de-merger, the company has already created new jobs and will be relocating other employees from a Chicago location to Farmington Hills.

As a further sign of strengthening and supporting the local community, the company surprised the leadership of Forgotten Harvest by presenting a check for $100,000 to the food rescue agency's capital fund campaign. The mission of Forgotten Harvest is to relieve hunger in the Detroit metropolitan community by rescuing surplus prepared and perishable food and donating it to emergency food providers. |GlobalGiants.com|

Edited & Posted by Editor | 5:48 AM | Link to this Post

October 9, 2007

Carnegie Medals Honors World's Great Philanthropists : GlobalGiants.com

The Tata family of India, Eli Broad, Heinz and Mellon Families to receive the Carnegie Medal of Philanthropy.

PITTSBURGH, Oct. 9 -- Four of the world's greatest philanthropists will be honored at the Carnegie Medals of Philanthropy celebration at 2 p.m. on Wednesday, October 17 at the Carnegie Music Hall in Pittsburgh.

This year's honorees are the Heinz family, the Mellon family, Eli Broad and the Tata family. The medals, created to honor Andrew Carnegie's career as a philanthropist, are awarded every two years to families and individuals who have dedicated their private wealth to the public good and who have sustained impressive careers as philanthropists.

Photo: Contemplating Philanthropy

The master of ceremonies for the event will be former NBC News anchor Tom Brokaw. Other notable presenters include Dr. A.P.J. Abdul Kalam, the former president of India; David Baltimore, a Nobel laureate in medicine and former president of the California Institute of Technology; Earl Powell III, director of the National Gallery of Art; and Agnes Gund, a 2005 Carnegie Medalist and president emerita of The Museum of Modern Art.

"Andrew Carnegie was determined to use his private wealth imaginatively, constructively, and systematically to address the fundamental problems of mankind, rather than simply to assuage symptoms," said Vartan Gregorian, president of Carnegie Corporation of New York and chair of the executive selection committee.

Photo: Carnegie Hall in New York City -- one of the Carnegie Institutions. Picture shows David Bernard conducting The Park Avenue Chamber Symphony at Carnegie Hall.

Created with the idea of serving as the "Nobel Prize for Philanthropy," the Carnegie Medals program began in 2001. This year's honorees cover a wide range of philanthropic efforts, both on the national and international stage:

• Eli Broad is a renowned business leader who built two Fortune 500 companies from the ground up over a five-decade career in business. He is the founder of both SunAmerica Inc. and KB Home (formerly Kaufman and Broad Home Corporation). Today, he and his wife, Edythe, are devoted to

philanthropy as founders of The Broad Foundations. With assets of more than $2.25 billion, The Broad Foundations are focused on entrepreneurship for the public good in education, scientific and medical research, and the arts. In an unprecedented partnership with the Massachusetts Institute of Technology, Harvard University and the Whitehead Institute, the Broads gave $200 million to create the Eli and Edythe Broad Institute for biomedical research. In fostering public appreciation for contemporary art, The Broad Art Foundation is a lending library of more than 1,200 artworks that have been loaned to more than 400 museums and university galleries worldwide.

• India's Tata family gives away between eight and 14 percent of the net profits from its controlling company each year to myriad causes: science, medicine, social services, health, civil society and

governance, rural welfare, performing arts, education and the needs of children. The Tata family legacy stretches back to the 19th century, when Jamsetji N. Tata started the Indian Institute of Science in Bangalore. Tata family's philosophy of "constructive philanthropy" has become embedded in its businesses, and has played a role in changing the traditional concept of charity throughout India. The Tata family is considered one of the few philanthropic forces in India with the potential to facilitate collaborative action on the problems that threaten individual, local and national development.

• The Heinz family's sustained philanthropic giving has supported the environment, education, economic opportunity and the arts as well as efforts to enhance the lives of women and children. In 1995, the family made one of the largest grants ever to benefit the environment $20 million to establish the Washington, D.C.-based H. John Heinz III Center for Science, Economics and the Environment. The Center brings together representatives of business, government, the scientific community and environmental groups to collaborate on the development of fair, scientifically sound environmental policies. Teresa Heinz will accept the award on behalf of the family.

• The Mellon family's impact on philanthropic giving began with Andrew Mellon's donation in the 1930s of his extensive art collection to provide the beginnings of the National Gallery of Art in Washington, D.C. as well as the Smithsonian's National Portrait Gallery. In 1969, Andrew's children Paul and Ailsa established the Andrew W. Mellon Foundation, which supports museums and art conservation, as well as higher education and scholarship, information technology research, performing arts and conservation, and the environment. In Pittsburgh, the family helped to create and continues to support Carnegie Mellon University.

This year's event is sponsored by UPMC and United States Steel Corporation. The Carnegie Institutions from around the world are Carnegie Corporation of New York (U.S.), Carnegies Belonningsfound for Heltemond (Denmark), Fondazione Carnegie (Italy), Foundation Carnegie (France), Carnegie Mellon University (U.S.), Carnegie Hall (U.S.), Carnegie Museums of Pittsburgh (U.S.), Fondation Carnegie pour les Sauveteurs (Switzerland), Carnegie Hero Fund Commission (U.S.), Carnegie Endowment for International Peace (U.S.), Carnegie United Kingdom Trust (U.K.), Carnegie Institution of Washington (U.S.), Carnegie Trust for the Universities of Scotland (U.K.), Carnegie Library of Pittsburgh (U.S.), Carnegie Council on Ethics and International Affairs (U.S.), Carnegie Heltefond for Norge (Norway), Carnegie Dunfermline Trust (U.K.), Carnegie Hero Fund Trust (U.K.), Carnegie Foundation for the Advancement of Teaching (U.S.), Carnegiestiflesen (Sweden), Carnegie Heldenfonds (Netherlands), Fondation Carnegie (Belgium) and Carnegie Stiftung fuer Lebensretter (Germany). |GlobalGiants.com|

Edited & Posted by Editor | 5:37 AM | Link to this Post

October 1, 2007

The Bank of New York Mellon Launches Global Brand Program : GlobalGiants.com

New Corporate Identity and Advertising to Spotlight People, Partnership and Performance.

NEW YORK, Oct. 1 -- The Bank of New York Mellon launched a new brand program today, highlighting the Company's global reach and its leadership across a number of high-growth businesses. The branding program follows the July 1 merger of The Bank of New York Company, Inc., and Mellon Financial Corporation and is supported by an extensive worldwide advertising campaign.

Also revealed today was the Company's new identity, a three-color logo depicting an arrow pointing to the future which will appear in all components of the program and unite the Company's businesses. The global advertising campaign began today in key industry and business publications, along with a new Web site (www.bnymellon.com) that showcases the Company's global leadership position. The television campaign will begin in mid-October in the U.S. and Europe. The advertising asks "Who's Helping You" as it illustrates how The Bank of New York Mellon has the expertise, products and services to help clients develop solutions to complex challenges.