March 15, 2010

Global Institutional Profiles Project: Thomson Reuters Launches Academic Reputation Survey

Thomson Reuters today announced it has launched the highly anticipated Academic Reputation Survey, which will help inform the Times Higher Education's influential World University Rankings.

The survey reflects a new approach to data gathering and analytics to provide a one-of-a-kind resource to the global scholarly community.

A unique feature of the Thomson Reuters Academic Reputation Survey is an opportunity for disciplinary focus: academics will highlight what they believe to be the strongest universities in their specific fields, both in teaching and research.

With the ability to select from hundreds of disciplines and over 6,000 academic institutions, scholars will have great latitude in pinpointing their reputation assessment.

"Researcher engagement is critical to ensuring that this new initiative delivers what the industry has long been asking for -- a more accurate representation of the institutional landscape, from the source," said Jonathan Adams, director of research evaluation at Thomson Reuters. "The survey results, combined with clear methodology, will provide the community with a thorough, accurate, and multi-faceted data source to support institutional assessment, comparisons and rankings."

Participants of the survey have been carefully selected from Thomson Reuters internal databases and supplemented by a third-party source for balanced coverage of disciplines and geographic regions.

The survey will represent thousands of researchers, university administrators, and students worldwide. And their responses will provide the most reliable and accurate representation of academic viewpoints used in the World University Rankings' seven year history, says Thomson Reuters.

The Academic Reputation Survey is part of the Thomson Reuters Global Institutional Profiles Project. The initiative will create data-driven profiles of globally significant research institutions -- combining reputation feedback, scholarly outputs, citation patterns, funding levels, and faculty characteristics across disciplines in one comprehensive database.

• The data can be packaged and analyzed to different specifications, giving organizations custom information for evaluating and benchmarking their performance and supporting efforts to secure research funding.

• Get the Report: New Outlooks on Institutional Profiles

Source: Thomson Reuters

|GlobalGiants.Com|

World University Rankings 2009: TOP 200 WORLD UNIVERSITIES

World University Rankings 2009: TOP 200 WORLD UNIVERSITIES

"Soon, any Academic Institution with Higher Global Ranking would be an Automatic Candidate for Grants, Funds, and Investment."

© GlobalGiants.Com. All Rights Reserved.

Edited & Posted by Editor | 5:09 PM | Link to this Post

December 17, 2009

Mergers and Acquisitions -- Strategic Deals and 'Mergers of Productivity' to Drive M&A in 2010: PricewaterhouseCoopers

There have been signs of life in the deal market during the second half of 2009, and mergers and acquisitions (M&A) activity is expected to pick up in 2010, according to PricewaterhouseCoopers' (PwC) Transaction Services practice.

While credit markets are easing for some participants, financing will remain the dominant challenge to M&A activity next year, increasing the pressure on middle market deals. Strategic buyers with strong balance sheets and robust cash reserves will be well-positioned for strategic M&A opportunities. As these strategic buyers take advantage of their ability to maneuver in the face of a challenging deal environment, PwC predicts they will pursue deals with a focus on synergies - including enhancing productivity, providing cost-savings and adding revenue volume to their businesses.

"Those who have built their balance sheets for a rainy day might come out of last year's storm to find the rainbow, and at the end of it, nicely-valued acquisition targets that provide opportunities for revenue growth and enhanced productivity," said Bob Filek, Partner with PricewaterhouseCoopers Transaction Services. "As a result, M&A activity in 2010 will be driven by strategic buyers who have access to capital and the strategic vision to capitalize on some of the best values we have seen in recent times."

"Companies have taken aggressive actions on costs; the low hanging fruit is gone, and to drive further efficiency they will look to combine with similar players to drive scale and enhance productivity. The 'merger of productivity' will be a driving force in 2010 as companies look to drive revenue growth and enhance margins," continued Filek.

Through the first eleven months of 2009, there were 6,772 deals worth a total of $614 billion, compared with 8,890 transactions worth a total of $1 trillion during the same period last year, according to financial data provider Thomson Reuters.

The credit freeze has impacted transactions across the board, including private equity (PE) and middle market transactions.

"There is still in excess of $1 trillion of capital committed to alternative investment funds sitting on the sidelines, waiting for the appropriate opportunities. The diversified private equity players have been bulking up their debt, hedge and distressed funds to take advantage of opportunities in distressed, reflecting their ability to evolve and successfully navigate choppy waters," said Greg Peterson, Partner with PricewaterhouseCoopers Transaction Services.

Regarding private equity exits, "we expect to see more IPOs coming to market in 2010 from private equity as the markets continue to firm up," noted Peterson. More the half of the IPOs completed during 2009 were by financial sponsor-backed (primarily private equity) companies, a trend expected to continue through the remainder of 2009 and 2010.

Sectors that continue to present opportunities include:

• Consumer Products:

As retailers continue to pressure margins and growth through private label strategies, consumer product companies are accelerating trade spend at the expense of margins. Watch for high-profile combinations as branded companies look to gain scale and negotiating leverage with retailers, while enhancing their scale to drive productivity. A focus on high-growth categories and emerging markets will also be in vogue in 2010.

• Technology:

The headline transactions of the past year - transformative deals - will continue as the battle over the data center and end-to-end services continues to drive the larger players. The large, mature players will also continue to absorb smaller companies who provide intellectual property that can be leveraged - at an array of multiples - as some will be seen as desirable by multiple players and others are made attractive by a higher bar to access in the public markets. At the other end of the scale, there is more consolidation to come amongst weaker players, especially in semiconductors.

• Energy:

The opening of the capital markets window (both debt and equity) will pave the way for increased M&A activity in 2010. The seller/buyer expectation gap is slowly narrowing. Large-cap exploration and production companies and Master Limited Partnerships have strengthened their balance sheets considerably and are ready to fuel growth again via the M&A route. PwC expects natural gas to continue to be a particular bright spot for acquisitions.

• Financial Services:

As the FDIC continues to take actions with troubled banking institutions, watch for consolidation among the regional banks at the hands of the FDIC to be a key theme of 2010. One key question is if private equity will take more seats at the banking deal table. PwC expects the asset management sector will also continue to be popular in this space.

• Automotive:

With the U.S. automotive industry remade, it will be time for the suppliers to resize and adjust their business models to the new paradigm. Watch for a realignment of product portfolios and manufacturing footprints as tier-one suppliers adjust to the new reality. Low-cost country sourcing will be a continued theme, while Asian acquirers may start to acquire more U.S.-based assets.

• Healthcare:

Once healthcare reform has run its course, look for the industry to ratchet up M&A activity. Consolidation will accelerate in the services, managed care and pharma sectors, driven by the need to reduce costs and increase productivity. Watch for seasoned leaders to embark on new ventures to shake up the business-as-usual model. The pharmaceuticals sector will continue pursue smaller acquisition targets, and explore areas less dependent on government, such as consumer product applications, animal health, vaccines, and biologics.

• Entertainment and Media:

Despite a sluggish economy, the Entertainment and Media sector still managed to pull off several high-profile entertainment deals in the second half of 2009. Look for strategic buyers to focus their efforts on content- and distribution-oriented acquisitions, both domestically and internationally, in response to favorable pricing in the market, as well as continuing to explore new media opportunities.

Other factors influencing M&A activity in 2010 may include the following scenarios:

• Private equity's ability to exit through Initial Public Offerings (IPOs) or acquisitions:

The IPO market has been re-established as a viable exit vehicle for private equity investments. IPO activity in Q4 of 2009 is expected to be the strongest quarter since 2007, with PE-backed deals contributing the majority of the volume in this deal channel. Assuming the equity markets do not experience a significant correction, PwC expects IPO activity to continue to increase in 2010.

• The "Wild Card":

How much would an economic double-dip rain on the M&A party? "We see continued weakness in key fundamental indicators, not the least of which is consumer demand," said Filek. "However, while we may see some challenges and market disappointments in 2010, the underlying fundamentals will outweigh the short-term stress, and companies will stay committed to their strategic vision and complete a lot of transactions in 2010."

Source: PricewaterhouseCoopers Transaction Services

|GlobalGiants.Com|

Edited & Posted by Editor | 11:50 PM | Link to this Post

December 16, 2009

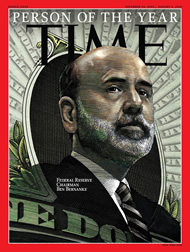

TIME Names United States Federal Reserve Chairman Ben Bernanke 2009 Person of the Year

TIME has named United States Federal Reserve Chairman Ben Bernanke the 2009 Person of the Year.

TIME's Person of the Year issue has the first full, on-the-record print interview with Bernanke since he became Chairman of the Federal Reserve.

IN A SERIES OF THREE INTERVIEWS, BERNANKE TELLS TIME:

• On the financial crisis:

"We came very, very close to a depression...The markets were in anaphylactic shock. I'm not happy with where we are, but it's a lot better than where we could be...Of course there were things we could have done better, but this was a perfect storm."

• On unemployment:

"The additional steps aren't as obvious or clear as the ones we've already taken. It's an enormous problem. There aren't easy solutions."

• On questions about his handling of Lehman, AIG and Bear Stearns:

"It's the price of success: people start to think you're omnipotent. We say we didn't have the authority, and it's 'Oh, you're the Fed. You could've come up with something.'"

• Bernanke tells TIME that major financial crises generally cost nations 5% to 20% of their national output. This panic seems likely to cost the U.S. a fraction of 1%. "How much would you pay to avoid a second Depression?" Bernanke asks. "I mean, this is a pretty good return on investment."

• On his background:

"I'm not one of those people who look at this as some kind of video game. I come from Main Street, from a small town that's really depressed. This is all very real to me."

• On banker pay:

"I think that bankers ought to recognize that the government and the taxpayer saved the financial system from utter collapse last year. And in recognizing that, I would think that bankers ought to look in the mirror and decide that perhaps there should be some more restraint in how much they pay themselves, given what the government and the taxpayer did to protect the system."

Source: TIME

|GlobalGiants.Com|

Edited & Posted by Editor | 10:24 AM | Link to this Post

November 20, 2009

Every GM Vehicle Sold Costs Taxpayers $12,200, Says National Taxpayers Union

The American taxpayer has put up $12,200 for every General Motors vehicle sold through the beginning of 2011, and $7,600 for every Chrysler vehicle sold as well, according to a new report issued by the 362,000-member National Taxpayers Union (NTU).

The report, The Auto Bailout - A Taxpayer Quagmire, is authored by NTU Adjunct Scholar Thomas D. Hopkins, Professor of Economics at Rochester Institute of Technology. Hopkins held senior management positions in two White House agencies during the Ford, Carter and Reagan Administrations. In the early 1980's, he served as Deputy Administrator, Office of Information & Regulatory Affairs, in the Office of Management & Budget.

Photo: 2010 Chevrolet Silverado 2500 HD LTZ Extended Cab.

"Every time someone in your neighborhood drives home in a shiny new Chevy Silverado, remember that it cost American taxpayers more than $12,000," said Pete Sepp, NTU Vice President for Policy and Communications.

The study found that the average American taxpaying family has invested roughly $800 in the auto bailouts so far. Moreover, the study found, the government support poured into General Motors, Chrysler, and GMAC - the financing subsidiary that supports sales at both - now stands at $78.9 billion. Given that figure, and an estimate of how many vehicles GM and Chrysler will sell through the end of 2010, the study finds that each vehicle one of the bailed-out companies sells costs taxpayers $10,700.

Finally, breaking down the costs by company, the study reports that every Chrysler vehicle sold costs taxpayers $7,600, and every GM vehicle sold costs taxpayers $12,200.

The research is based upon a November study released by the Government Accountability Office (GAO), entitled "Continued Stewardship Needed as Treasury Develops Strategies for Monitoring and Divesting Financial Interests in Chrysler and GM," a follow-up report on the "Troubled Asset Relief Program," as well as statements and reports released from the U.S. Treasury.

The study also found that during the first ten months of 2009, GM and Chrysler sales fell further than other major auto producers, down 33.4 percent and 38.9 percent, respectively.

Photo: US Treasury Department, Washington, DC, USA.

"While the prospect of repayment of GM and Chrysler loans might be expected, after bankruptcy the vast majority of the bailout funds are no longer legal obligations of the newly-structured GM and Chrysler," the study concludes. "If Americans are to believe public officials' claims that the government will eventually reprivatize the auto industry, the necessity of a thoughtful exit plan is essential. However, at this time no such plan exists, making it likely that the Treasury will not recover its investment."

Source: National Taxpayers Union, 108 North Alfred St., Alexandria, VA 22314, USA.

|GlobalGiants.Com|

"The names 'GM' and 'General Motors' continue to take a beating.

But the value of the name 'Chevrolet' (as well as that of 'Cadillac' and 'Buick') remains unaffected. It is the same it was 20 or 30 years ago.

If GM had projected 'Chevrolet' as its flagship brand (it may do so even today!), it would have boosted the buyers' confidence in all its brands and nameplates and would have restored the investors' confidence in the company."

© GlobalGiants.Com. All Rights Reserved.

Edited & Posted by Editor | 8:16 AM | Link to this Post

October 28, 2009

Students from Top Academic Institutions Choose The World's Top 50 Most Attractive Employers

Compiled from 11 out of the 12 leading economies, nearly 120,000 students from top academic institutions chose their ideal companies to work for.

Google is the world's most attractive employer, followed closely by its rival, Microsoft. This is the only global index of employer attractiveness and highlights the world's most powerful employer brands, i.e., those companies that are the most successful in talent attraction and retention.

The study has been conducted by Universum. Universum is a global Employer Branding company. It is headquartered in Sweden and has presence in more than 28 countries.

Employers today are faced with a shrinking global workforce, a lack of skilled workers and an increasingly demanding generation of new talent. To secure talent under these conditions, employers must develop true and differentiating employer brands. The employers that feature in this Top 50 all have one thing in common: they successfully appeal to current and future talent, and they are aware of how scarce talent is.

The global ranking is based on the national rankings that Universum conducts annually all over the world. The companies that are featured in at least eight out of the twelve leading economies were included in the global ranking, and the 50 most attractive employers were identified. The countries represented in the Global Top 50 rankings are the US, Japan, China, Germany, France, UK, Italy, Russia, Spain, Canada and India.

• Despite it being one of the toughest years for car manufactures, BMW and Daimler appear in the Global Top 50 rankings.

The Big Four accountancy and professionals service firms; financial services companies and management consultancies, still remain strong. In spite of this year being one of worst recessions since the Second World War, they remain globally attractive employers and are especially popular with business students. IT employers are highly placed in the engineering ranking, which can be expected, with Google, Microsoft and IBM in the top three.

The fast moving consumer goods companies and employers in the retail sector are also attractive employers, recognised for their universal appeal as employers in the graduate recruitment market, attracting students from both a business and engineering background.

"These companies in the Top 50 really work with employer branding strategically. The Big Four, for example, are all in the top 10 business ranking, as they have employer branding as part of their business strategy. Many associate their corporate brands to people. This is normal for the service industry, but it is a new approach for other companies" says Michal Kalinowski, Universum CEO. "These companies are in the Top 50 because they are focused, consistent and differentiate themselves in their communication."

Irrespective of rank, the Top 50 Global Employers for business and engineering students are very similar, showing strong employer brands transcend many skill and industry groups. Conversely, Oracle and Philip Morris make it to the Top 50 for business students, but not for engineering students. GlaxoSmithKline and Alcatel-Lucent appear in the engineering ranking, yet not in the business ranking.

What the rankings most certainly reveal is that the big multinational brands are favored. Due to the globalization of the talent market, multinational companies are generally recognized as being attractive employers. Findings from Universum's various student surveys show that students would like a good career reference, an international career and an employer that can offer secure employment. Lovisa Öhnell, head of research and consulting at Universum, comments, "These multinational brands are globally well-known, they offer relocation opportunities and business travel, interaction with clients and colleagues in various countries, and due to their size and economic strength, they are also seen as being the safest choice."

• GLOBAL TOP 50 - ACCORDING TO BUSINESS STUDENTS

Company - Ranking 2009

Google - 1

PricewaterhouseCoopers - 2

Microsoft - 3

Goldman Sachs - 4

Ernst & Young - 5

Procter & Gamble - 6

J.P. Morgan - 7

KPMG - 8

McKinsey & Company - 9

Deloitte - 10

The Boston Consulting Group - 11

BMW - 12

Coca-Cola - 13

L'Oréal - 14

Morgan Stanley - 15

Sony - 16

IBM - 17

Johnson & Johnson - 18

Deutsche Bank - 19

General Electric - 20

Citigroup - 21

HSBC - 22

Accenture - 23

Nestlé - 24

Credit Suisse - 25

Bain & Company - 26

Unilever - 27

UBS - 28

Nokia - 29

Intel - 30

Esso/ExxonMobil - 31

Kraft Foods - 32

Shell - 33

Hewlett-Packard - 34

Mars (Masterfoods) - 35

Pfizer - 36

Siemens - 37

Philips - 38

Oracle - 39

Bayer - 40

Philip Morris - 41

DHL - 42

BP - 43

Bosch - 44

Cisco - 45

Daimler - 46

Ericsson - 47

ABB - 48

Novartis - 49

Schlumberger - 50

• GLOBAL TOP 50 - ACCORDING TO ENGINEERING STUDENTS

Company Ranking 2009

Google - 1

Microsoft - 2

IBM - 3

BMW - 4

Intel - 5

General Electric - 6

Sony - 7

Siemens - 8

Shell - 9

Procter & Gamble - 10

Johnson & Johnson - 11

Hewlett-Packard - 12

Cisco - 13

Esso/ExxonMobil - 14

McKinsey & Company - 15

Schlumberger - 16

BP - 17

L'Oréal - 18

Nokia - 19

Accenture - 20

Coca-Cola - 21

Philips - 22

Goldman Sachs - 23

Nestlé - 24

Pfizer - 25

Bosch - 26

The Boston Consulting Group - 27

J.P. Morgan - 28

Deloitte - 29

Morgan Stanley - 30

GlaxoSmithKline - 31

Ericsson - 32

Ernst & Young - 33

ABB - 34

Bayer - 35

Unilever - 36

PricewaterhouseCoopers - 37

Deutsche Bank - 38

HSBC - 39

Kraft Foods - 40

Bain & Company - 41

Citigroup - 42

Alcatel-Lucent - 43

Daimler - 44

Novartis - 45

Mars (Masterfoods) - 46

KPMG - 47

Credit Suisse - 48

DHL - 49

UBS - 50

The Global Top 50 rankings are based on the employer preferences of nearly 120,000 final year students, who were surveyed at the top academic institutions in the world's 11 largest economies. The global rankings are based on the annual surveys conducted on a global level in 2009. Each student is presented with a list of 130 to 150 national and international employers, chosen by university students through an independent and structured nomination and assessment process. On a global level, this represents 800 considered employers. Students acknowledge those companies they would consider working for. Out of the companies selected as 'considered employers', each student then selects his or her five Ideal Employers. The Global Top 50 is based on the frequency of being selected as an Ideal Employer overall within 11 markets: US, Japan, China, Germany, France, UK, Italy, Russia, Spain, Canada and India.

• The Global Top 50 is the most comprehensive study ever conducted on employer attractiveness.

• This Practical Global Business Study is being presented for the First Time.

|GlobalGiants.com|

Edited & Posted by Editor | 6:34 AM | Link to this Post

September 29, 2009

Equity Analytics: Mergent Announces Launch of Next Generation Platform

• Mergent Inc., in partnership with financial industry veterans Jeff McMains, CFA and Chris Rowberry, CFA have formed Intrinsic Research Systems, Inc. to provide next generation equity analytics applications and databases to the institutional investment management community.

• The Intrinsic Research platform will make its debut at the CFA Institute's Equity Research and Valuation Conference on December 3, 2009 in New York.

According to Mergent, Intrinsic is a desktop research application that is designed to help investment management professionals improve their equity research, portfolio management, economic analysis, and investment strategy decision-making processes.

"Buy-side portfolio management and equity analysis workflow requirements are the building blocks for the design of the powerful yet easy-to-use Intrinsic Research platform which includes an add-in for Microsoft Excel," informs Mergent Inc. "The platform has been built from the ground up, utilizing the latest smart client technology to enhance the end-user experience and simplify IT deployment. Robust graphical valuation analysis capabilities form the cornerstone of the Intrinsic application suite. Intrinsic's integrated central database of clean and deep company, industry, sector, economic and quantitative data has been specially constructed to highlight both short-term and long-term valuation and growth trends."

In addition to fundamental analytics, Intrinsic offers integrated access to various equity analysis modules for quantitative, economic, and technical analysis as well as screening, scoring and report-writing capabilities.

"We are excited to bring to market a dynamic application that covers all aspects of the equity selection process," says Jeff McMains, CFA. "Our clients will embrace a platform that is continually evolving with new features and data, particularly as compared to many of the technically outdated research systems available today."

Jonathan Worrall, CEO of Intrinsic and Mergent adds, "The combined forces of Intrinsic and Mergent provides a bright new choice for portfolio managers and analysts that demand cutting edge equity analytics and highly detailed data. Together, we leverage over a century of data experience and the expertise to transform that data into precise, actionable information that empowers the buy-side community."

Mergent, Inc. is a leading provider of critical business and financial data on global publicly listed companies, indices and exchanges. The company is headquartered in New York, NY, and Charlotte, NC, with sales offices in key North American cities as well as London, Tokyo, Toronto, Sydney and Hong Kong.

Source: Mergent, Inc.

|GlobalGiants.com|

Edited & Posted by Editor | 6:00 AM | Link to this Post

September 22, 2009

Clinton Global Initiative: President Barack Obama and President Bill Clinton Address the Opening Plenary Session of the Fifth Annual Meeting

Among others, following are joining President Clinton in Panel Discussion on Global Challenges:

• Michelle Bachelet, President of the Republic of Chile.

• Mike Duke, CEO of Wal-Mart Stores.

• Muhtar Kent, Chairman of the Board and CEO of Coca-Cola.

• Kevin Rudd, Prime Minister of the Commonwealth of Australia.

Photo: President Barack Obama and President Bill Clinton Greet Each Other on Stage at the Opening Plenary Session of the Fifth Annual Meeting of the Clinton Global Initiative.

Today, in New York, President Barack Obama joined President Bill Clinton to open the Fifth Annual Meeting of the Clinton Global Initiative.

The meeting is bringing together leaders from the political, corporate, and civil sectors to develop and implement innovative solutions to the world's most pressing problems.

Established in 2005 by President Bill Clinton, the Clinton Global Initiative (CGI) brings together a community of global leaders to devise and implement innovative solutions to some of the world's most pressing challenges.

"This week, even as we gather at the United Nations to discuss what governments can do to confront the challenges of our time, even as we're joined tonight by so many presidents and prime ministers - this Global Initiative reminds us what we can do as individuals: that you don't have to hold public office to be a public servant," President Obama said, adding: "That's the beauty of service - anyone can do it and everyone should try."

"In the midst of a global financial crisis, I don't think it's a coincidence that more people are attending this meeting than ever before," President Clinton said. "Since 2005, it has become clear that CGI has found an effective model for addressing challenges around the world. Our members have made more than 1,400 commitments affecting more than 200 million people around the world. Because of their efforts, more than 10 million children have access to a better education, 48 million people have better health care, and more than 12 people million have safe drinking water. But there is still work to be done."

President Clinton announced that more than 60 current and former heads of state, 500 business leaders, and 400 leaders from nongovernmental and philanthropic organizations will be attending the meeting, representing 84 countries.

Photo (Added Sep 23): From left: Diane Sawyer moderates panel including Lloyd Blankfein, chairman and CEO of The Goldman Sachs Group, Merlanne Verveer, ambassador-at-large for global women's issues at the U.S. Department of State, Robert Zoellick, president of The World Bank Group, Zainab Salbi, founder and CEO of Women for Women International, Rex Tillerson, chairman and CEO of ExxonMobil, and Edna Adan, director and founder of the Edna Adan Maternity and Teaching Hospital (speaking).

Photo (Added Sept 23): From left to right, Matthew Bishop, New York Bureau Chief and American Business Editor, The Economist, Al Gore, Chairman, The Alliance for Climate Protection, Ngozi Okonjo-Iweala, Managing Director, The World Bank Group, Jack Ma, Chairman and CEO, Alibaba Group, Judith Robin, President, The Rockefeller Foundation, Muhammad Yunus, Founder and Managing Director, Grameen Bank.

Source: Clinton Global Initiative

|GlobalGiants.com|

Edited & Posted by Editor | 11:44 PM | Link to this Post

August 21, 2009

Harvard, Princeton, and Williams top in U.S. News Media Group's 26th Annual America's Best Colleges Rankings

New edition includes specialty rankings and online guides for admission and paying for college.

• America's Best Colleges Rankings 2010

U.S. News Media Group today released the 2010 edition of America's Best Colleges, which includes rankings of more than 1,400 schools nationwide USA. Harvard University and Princeton University tie the top of the list for Best National Universities, while Williams College is ranked top for Best Liberal Arts College.

Over the past 26 years, the U.S. News college rankings, which groups schools based on categories created by the Carnegie Foundation for the Advancement of Teaching, has grown to be the most comprehensive research tool for students and parents considering higher education opportunities. The America's Best Colleges ranking package, which includes editorial content and multimedia resources, is helping families navigate the difficult decisions involved throughout the college process, from college admission and selection to financing options.

"As it becomes increasingly difficult to choose the right school - and pay for it - U.S. News strives to provide students and families with the best information to help guide them through the entire college process," said U.S.News & World Report Editor Brian Kelly. "This year, the recession has seriously challenged the traditional model of paying for college, and so we've developed ranking and editorial content to address the many ways to finance an education as well as information on how to get the most out of such a big investment."

Photo: Stanford University student Kristen Lence studies on her Apple MacBook on the Stanford University campus in Palo Alto, California.

The 2010 America's Best Colleges features the established rankings of the Best National Universities, Best Liberal Arts Colleges, and Best Historically Black Colleges, and includes rankings of Best Colleges for Financial Aid, A+ Schools for B Students, and Up-and-Coming Schools.

The 2010 America's Best Colleges package provides thorough examination of how more than 1,400 accredited four-year schools compare on a set of 15 widely accepted indicators of excellence. Among the many factors weighed in determining the rankings, the key measures of quality are: peer assessment, graduation and retention rates, faculty resources, student selectivity, financial resources, alumni giving, and graduation rate performance (National Universities and Liberal Art Colleges).

Photo: President Barack Obama poses with six of the Barack Obama Scholars at Arizona State University commencement.

America's Best Colleges Rankings 2010

• Best National Universities

1. Harvard University (MA)

• Princeton University (NJ)

3. Yale University (CT)

4. California Institute of Technology

• Massachusetts Inst. of Technology

• Stanford University (CA)

• University of Pennsylvania

• Best Liberal Arts Colleges

1. Williams College (MA)

2. Amherst College (MA)

3. Swarthmore College (PA)

4. Middlebury College (VT)

• Wellesley College (MA)

• Up-and-Coming Schools

• National Universities

1. Univ. of Md. - Baltimore County

2. George Mason University (VA)

• Northeastern University (MA)

4. Drexel University (PA)

5. Arizona State University

• University of Central Florida

• Liberal Arts Colleges

1. Hendrix College (AR)

2. Agnes Scott College (GA)

• Davidson College (NC)

• Furman University (SC)

• Dickinson College (PA)

• University of Richmond (VA)

• Ursinus College (PA)

The U.S. News Media Group is a multi-platform publisher of news and analysis.

Source: U.S. News Media Group

|GlobalGiants.com|

"A child is not a vase to be filled, but a fire to be lit."

-- Francois Rabelais

Edited & Posted by Editor | 4:56 AM | Link to this Post

July 9, 2009

G8 Summit Opens in Italy

The 2009 G8 Summit is being held in L'Aquila, Italy, from 8 to 10 July. The main issues on the Italian Presidency's agenda are the economic crisis and a boost to growth, relaunching international trade, welfare policies, climate changes, development in the poor countries and in Africa, food security and safety, access to water, health, and the resolution of regional crises.

Photos: July 8, 2009, first day of the G8 Summit in L'Aquila. Italian Prime Minister Silvio Berlusconi and US President Barack Obama while visiting the historical center of L'Aquila destroyed by the earthquake of 6 April. Ansa photos: Maurizio Brambatti

Photo: Japanese Prime Minister Taro Aso, signs the G8 logo plaque on the first day of the G8 Summit in L'Aquila. ANSA Photo: Ettore Ferrari

Photo: The President of the Russian Federation , Dmitry Medvedev, signs the G8 logo plaque on the first day of the G8 Summit in L'Aquila. ANSA Photo: Ettore Ferrari

Photo: Italian Prime Minister Silvio Berlusconi, signs the G8 logo plaque on the first day of the G8 Summit in L'Aquila. ANSA Photo: Ettore Ferrari

Photo: German Chancellor, Angela Merkel , signs the G8 logo plaque on the first day of the G8 Summit in L'Aquila. ANSA Photo: Ettore Ferrari

Photo: Swedish Prime Minister, Fredrik Reinfeldt, signs the G8 logo plaque on the first day of the G8 Summit in L'Aquila. ANSA Photo: Ettore Ferrari

Photo: British Prime Minister Gordon Brown, signs the G8 logo plaque on the first day of the G8 Summit in L'Aquila. ANSA Photo: Ettore Ferrari

Photo: The EU Commission President, Manuel Barroso, signs the G8 logo plaque on the first day of the G8 Summit in L'Aquila. ANSA Photo: Ettore Ferrari

Photo: French President, Nicolas Sarkozy, signs the G8 logo plaque on the first day of the G8 Summit in L'Aquila. ANSA Photo: Ettore Ferrari

Photo: The President of United State, Barack Obama, signs the G8 logo plaque on the first day of the G8 Summit in L'Aquila. ANSA Photo: Ettore Ferrari

Photo: The G8 logo plaque with all the leaders' signatures, on the first day of the G8 Summit in L'Aquila. ANSA Photo: Ettore Ferrari

Photo: The interior of the Main Conference hall, where the Summit meetings are to be carried out in the premises of the Coppito Guardia di Finanza campus. Photo taken on 7 July 2009, the eve of the G8 Summit. ANSA Photo: Ettore Ferrari

|GlobalGiants.com|

Edited & Posted by Editor | 10:19 AM | Link to this Post

July 2, 2009

Companies Stockpiling Cash, Credit Access Still Tight

42% increase short-term holdings; most move to more conservative vehicles.

With little easing in access to credit, U.S. organizations are continuing to stockpile cash, according the Association for Financial Professionals' 2009 Liquidity Survey. Almost three-quarters (72%) of companies had increased or maintained their U.S. cash balances during the first part of 2009.

According to the new AFP survey, 42% of organizations increased their U.S. cash and short-term investment balances between December 2008 and May 2009, while 30% saw no significant change in short-term cash balances. More than a quarter (28%) of organizations saw their U.S. cash and short-term investment balances deteriorate over the six-month period. Organizations with non-investment grade ratings were more likely to have seen their cash and short-term investment balances shrink.

"Despite unprecedented government action, the lack of any significant thaw in short-term credit access is extremely troubling and many companies are reacting by stockpiling cash," said Jim Kaitz, President and CEO of AFP. "While, many organizations with their strong cash positions will be well-positioned once the economy begins to improve, overall economic conditions will not improve until organizations can begin using their cash in activities that foster growth."

The fourth annual AFP 2009 Liquidity Survey was underwritten by The Bank of New York Mellon.

Despite reports of an easing in the corporate credit markets, over half (59%) of respondents indicated that their organizations' access to short-term credit had not changed significantly since the beginning of 2009. A larger percentage of organizations reported that credit was less available (27%) than those who indicated that credit access had improved (14%). Two-thirds expect their access to short-term credit to remain the same over the next year.

Overall, only one-quarter (27%) of organizations expect to decrease their U.S. short-term cash and investments balances over the next year.

"The turbulence of the present period has had no small impact on the liquidity needs and practices of individuals and corporations worldwide," said Eric Kamback, the Bank of New York Mellon's CEO of Treasury Services. "The survey also revealed that many believe the tightening of available credit will persist in 2009, so conservative, safety-based investment strategies can be expected to continue."

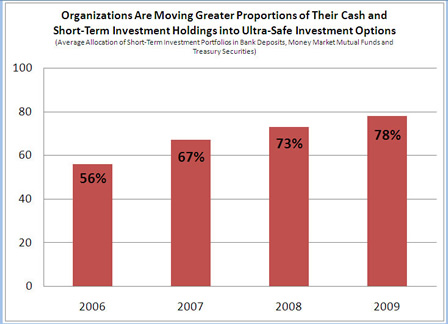

Organizations have moved to a more conservative investment strategy for their short-term balances and have reduced the number of vehicles they use for short-term investments, allocating 78% of their short-term investment balances to three safe and liquid vehicles: bank deposits, money market mutual funds and Treasury securities.

The use of commercial paper, separately managed accounts and auction-rate securities declined significantly over the past year. While investment policies allow for the use of four or more investment vehicles, on average, organizations use 1.6 investment vehicles compared to 2.4 options in 2008, the report says.

• AFP 2009 Liquidity Survey (PDF)

Source: Association for Financial Professionals

|GlobalGiants.com|

• GlobalGiants.Com is Member of the Boxxet Network The Exxchange (Finance and the Economy)

Edited & Posted by Editor | 2:53 AM | Link to this Post

June 3, 2009

U.S. Chamber of Commerce to Monitor GM and Chrysler Restructuring

Photo: Evolution of Motor Car: The original Benz patent motor car of 1888 in the Dr. Carl Benz Automotive Museum in Ladenburg, Germany. (Photo © Daimler AG)

Thomas J. Donohue, President and CEO of the U.S. Chamber of Commerce, has issued the following statement on the U.S. Federal Administration's plan to restructure General Motors and the impending ruling on Chrysler:

"The future success of General Motors and Chrysler ultimately depends on whether they can profitably design and build cars that Americans and other consumers actually want to buy.

Our biggest concern with the restructuring plan announced today is the potential for governments and unions to influence production, product, workforce, and management decisions in ways that could jeopardize the automakers' chances for survival, put politics and special interests above sound business strategy, and disrupt our nation's trading relationships across the world.

For example, the UAW has said that it pressured GM to change where the company plans to produce a new line of smaller cars. And as part of the GM restructuring, the administration has reportedly closed the U.S. market to Opel and blocked Opel's forays into China so it could not compete with GM -- clear examples of market manipulation and protectionism.

If members of Congress, along with government officials from the United States to Germany to Canada, are allowed undue influence over management's decisions, then you can write this down: These companies will not return to profitability and their survival will be seriously challenged. The global talent that exists in the automotive sector must be allowed to do its job and be paid on a competitive basis. Management must be permitted to make tough decisions in a competitive global market without political interference.

So going forward, the U.S. Chamber will carefully monitor the activities of the new GM and Chrysler boards, and we will expose and fight any counterproductive influence by government, unions, or politicians over decisions that should be left to management. And we will continually insist that government reduce and eliminate its ownership stake as soon as possible."

(The U.S. Chamber is the world's largest business federation representing more than 3 million businesses and organizations of every size, sector, and region.)

Source: U.S. Chamber of Commerce

|GlobalGiants.com|

Edited & Posted by Editor | 2:39 PM | Link to this Post

June 2, 2009

Global Consumer Recession Index Reveals Most and Least Affected Countries

U.S.A. is among the most impacted nations worldwide.

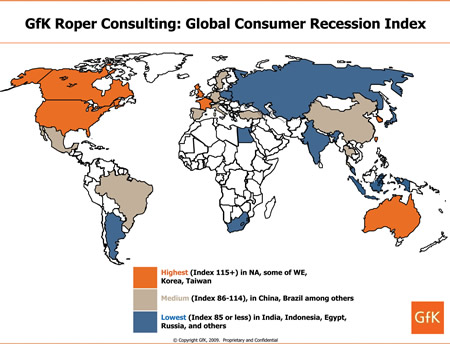

GfK Roper Consulting, a division of GfK Custom Research North America, today announced highlights from its first Global Consumer Recession Index, ranking the impact of the economic climate on individuals worldwide based on their level of concern, distress and reaction.

Segmenting the countries by high, medium and low impact, the Index reveals consumers in U.S., Taiwan, Canada, Korea, the UK, France and Australia are feeling most affected. Comparatively, India, Japan, Russia, Argentina, South Africa and Argentina all landed low on the impact scale.

"What's clear is that the global recession is not equally distributed," explains Nick Chiarelli, Director of Consumer Trends, GfK Roper Consulting. "To truly understand the impact of today's economic environment, it's vital to view this not as one blanket fiscal storm but rather as a series of localized recessions."

Based on GfK Roper Consulting's 2009 GfK Roper Mood of the World(R) Study, the Index was created by averaging, weighting and combining the following three measures to calculate an overall score in terms of how consumers are feeling:

• Concern - Respondents list their top-three worries from a selection of 21 economic, social and political issues. "Recession" ranked as the top concern globally. Regarding the highest levels of economic concern, Asian consumers topped the list while the U.S. landed in 15th place just behind its northern neighbor Canada (14th).

• Distress - Consumers indicate which positive and negative financial-related events they've experienced from a list of eight. Globally, 62% say they faced a negative event (e.g. losing their job or having difficulty paying their bills) in the past 12 months and the U.S. clocked in higher at 77% with Canada not far behind at 72%. Americans are also among the most distressed, following only Turkey.

• Reaction - Participants report where they've cut back from a list of 26 items and activities as well as which of 10 money-saving strategies they've employed. Consumers in English-speaking nations such as the U.S., Australia, Canada and the UK are the most likely to be doing things to cut back and save money.

Worldwide, the top cutback area is "dining out", whereas "shopping more carefully for everyday items" is the top-ranked money-saving strategy. Among Americans and Canadians, "dining out" also ranked first in cutbacks while the number one strategy for saving cash is using coupons.

"Localized marketing efforts are absolutely essential in this environment of cautious spending. Companies will benefit most by tailoring their strategies to address the concerns driving consumer behavior as they vary across several regions.", concludes GfK's Nick Chiarelli.

Source: GfK Roper Consulting

|GlobalGiants.com|

Edited & Posted by Editor | 9:22 AM | Link to this Post

May 1, 2009

General Motors Announces Full Cooperation with Obama Administration

GM says it is poised to become a Leaner, More Viable Company.

General Motors Corporation has issued the following statement:

"We are deeply appreciative for President Obama's strong commitment and support of the American auto industry and its employees. Like him, we firmly believe that the best days of America's auto manufacturers--including Chrysler--lay ahead. GM remains focused on accelerating the speed of its operational restructuring and reducing the liabilities and debt on its balance sheet. We look forward to working with the President's Auto Task force to do so and are committed to transparent reporting of our restructuring every step of the way."

Earlier, it issued a Press Release on its Updated Viability Plan and Restructuring of U.S. Operations. General Motors' updated Viability Plan will speed the reinvention of GM's U.S. operations into a leaner, more customer-focused, and more cost-competitive automaker, the Release said.

The Viability Plan is included in an exchange offer whereby GM is offering certain bondholders shares of GM common stock and accrued interest in exchange for certain outstanding notes.

The Revised Viability Plan gives importance to the following points:

• A focus on four core brands in the U.S. - Chevrolet, Cadillac, Buick and GMC - with fewer nameplates and a more competitive level of marketing support per brand.

• A more aggressive restructuring of GM's U.S. dealer organization to better focus dealer resources for improved sales and customer service.

• Improved U.S. capacity utilization through accelerated idling and closures of powertrain, stamping, and assembly plants.

• Lower structural costs.

![]()

"We are taking tough but necessary actions that are critical to GM's long-term viability," said Fritz Henderson, GM president and CEO. "Our responsibility is clear - to secure GM's future - and we intend to succeed. At the same time, we also understand the impact these actions will have on our employees, dealers, unions, suppliers, shareholders, bondholders, and communities, and we will do whatever we can to mitigate the effects on the extended GM team."

GM in the U.S. will focus its resources on four core brands, Chevrolet, Cadillac, Buick and GMC. The Pontiac brand will be phased out by the end of 2010. GM will offer a total of 34 nameplates in 2010, a reduction of 29 percent from 48 nameplates in 2008. This four-brand strategy will enable GM to better focus its new product development programs and provide more competitive levels of market support, the Press Release clarifies.

GM anticipates reducing its U.S. dealer count from 6,246 in 2008 to 3,605 by the end of 2010, a reduction of 42 percent. According to GM, this reduction in U.S. dealers will allow for a more competitive dealer network and higher sales effectiveness in all markets.

Photo: 2009 Chevrolet Malibu LT

Photo: 2010 Chevrolet Spark

Photo: Chevrolet Aveo5 LT Hatchback.

Photo: 2009 Chevrolet Silverado LT, Z71 Crew Cab

Photo: 2011 Chevrolet Volt Production Show Car

"We have strong new product coming for our four core brands: the Chevrolet Camaro, Equinox, Cruze and Volt; Buick LaCrosse; GMC Terrain; and Cadillac SRX and CTS Sport Wagon and Coupe," said Henderson. "A tighter focus by GM and its dealers will help give these products the capital investment, marketing and advertising support they need to be truly successful."

The Viability Plan also lowers GMNA's breakeven volume to a U.S. annual industry volume of 10 million total vehicles, based on the pricing and share assumptions in the plan. As a result of these and other actions, GMNA's structural costs are projected to decline 25 percent, from $30.8 billion in 2008 to $23.2 billion in 2010, a further decline of $1.8 billion by 2010 versus the February 17 Plan, the Press Release explains.

Another key element of GM's restructuring will be taking the necessary actions to strengthen its balance sheet. "A stronger balance sheet would free the company to invest in the products and technologies of the future," Henderson said. "It will also help provide stability and security to our customers, our dealers, our employees, and our suppliers."

"The Viability Plan reflects the direction of President Obama and the U.S. Treasury that GM should go further and faster on our restructuring," Henderson said. "We appreciate their support and direction. This stronger, leaner business model will enable GM to keep doing what it does best - provide great new cars, trucks and crossovers to our customers, and continue to develop new advanced propulsion technologies that are vital for our country's economy and environment."

Source: General Motors

|GlobalGiants.com|

Edited & Posted by Editor | 2:16 AM | Link to this Post

April 3, 2009

The University of Illinois at Chicago (UIC) Forum to focus on How Cities can Lead the Way to a Global Economic Recovery

U.S. Vice President Joe Biden to Headline UIC's Fifth Annual Richard J. Daley Urban Forum.

Photo: U.S. Vice President Joe Biden with Mayor Richard M. Daley at the Chicago Global Cities Forum. (City of Chicago, Antonio Dickey) [Photo Added: May 1, 2009]

PHOTO: UNIVERSITY OF ILLINOIS COLLEGE OF ENGINEERING COMPUTER SCIENCE FACILITY

The University of Illinois at Chicago (UIC) and the Daley family will host the fifth annual Richard J. Daley Urban Forum, titled "Global Economic Recovery: Cities Lead the Way." U.S. Vice President Joe Biden will give the keynote address at this year's Forum, which will be held on Monday, April 27 beginning at 8:30 a.m. on the UIC campus.

The Forum will bring together municipal leaders from around the world, business leaders, public officials, policymakers, leading scholars and commentators for an intimate and interactive dialogue that examines the vital role cities will play in a successful recovery from today's global economic crisis.

Vice President Biden will be joined at the Forum by Chicago Mayor Richard M. Daley and a rich host of panelists providing diverse perspectives about how cities are crucial to recovery, what kinds of obstacles exist and the kinds of imaginative steps cities are already taking.

"We are thrilled and honored to have Vice President Biden join us for this year's Forum," said Mayor Daley. "President Obama and Vice President Biden understand the great role cities play in driving the larger economy. By working collaboratively, sharing innovative ideas and unleashing the entrepreneurial spirit and imagination, cities can lead our nation to a healthy and much needed economic recovery."

The Forum will feature three panels: "Economic Recovery and Urban Reinvestment," addressing the impact of national stimulus plans and regional and local initiatives on urban areas as well as key obstacles to these recovery efforts; "Economic Revitalization: Education and Healthcare," exploring how cities--as the center of innovation, creativity and entrepreneurship--can take the imaginative steps needed to climb out of today's world recession in a way that reaches far beyond urban areas; and a "Global Town Meeting" where mayors from more than 30 global cities will offer examples of innovative programs from their own cities in response to the global economic crisis. Panel formats are subject to change.

"The Forum has become a significant venue for the exchange of ideas and the exploration of strategies that address social and economic issues confronting urban communities in the United States and around the globe," said UIC Chancellor Paula Allen-Meares. "In 2008, for the first time in history, more than half of the world's people lived in urban areas. This global demographic change contributes to the urgency of the forum. Thus, UIC is proud to host this event."

Photo: Chicago Skyscrapers seen from Navy Pier

The current economic crisis has imperiled both public and private finance and cost millions of citizens their jobs, homes and access to healthcare and education. While cities have been among the hardest hit economically, they also contribute the majority of the world's economic gross product and are responsible for most new job creation. Therefore, urban vitality is crucial to recovery.

Participants in this year's Forum include Marshall M. Bouton, President, The Chicago Council on Global Affairs; Victoria J. Chou, Dean, College of Education, University of Illinois at Chicago; Carol Coletta, President and Chief Executive Officer, CEOs for Cities; Richard M. Daley, Mayor, City of Chicago; Bruce Katz, Vice President, Brookings Institution; Michael H. Moskow, Former President, Federal Reserve Bank of Chicago and Senior Fellow, The Chicago Council on Global Affairs; Norbert Riedel, Corporate Vice President and Chief Scientific Officer, Baxter International, Inc. and Bernard Shaw, principal anchor emeritus, CNN.

The Urban Forum, held at the UIC Forum, 725 W. Roosevelt Rd., is open to the public. The registration fee will be waived for all UIC faculty, staff and students, as well as students from other universities. Students attending the Forum must present a valid college ID on the day of the event.

Cities expected to be represented at this year's forum include: Algiers, Algeria; Bangkok, Thailand; Beijing, China; Belgrade, Serbia; Bogota, Colombia; Busan, Republic of Korea; Cartagena, Colombia; Casablanca, Morocco; Chicago, USA; Doha, Qatar; Dubai, United Arab Emirates; Galway, Ireland; Glasgow, Scotland, United Kingdom; Hamburg, Germany; Helsinki, Finland; Jeddah, Saudi Arabia; Kuwait City, Kuwait; Kyiv, Ukraine; Lahore, Pakistan; Manila, The Philippines; Moscow, Russia; Nairobi, Kenya; Paris, France; Petach Tikva, Israel; Prague, Czech Republic; Reykjavik, Iceland; Riyadh, Saudi Arabia; Santo Domingo, Dominican Republic; Shenyang, China; Soriano, Uruguay; Tripoli, Lebanon; Vilnius, Lithuania and Windsor, Canada. Participating cities are subject to change.

Photo: Chicago Skyline

The 2009 Forum will be partially funded through sponsors including American Airlines, Ariel Investments, AT&T, Bank of America, Baxter, Blue Cross Blue Shield of Illinois, Boeing, The Chicago Community Trust, Chicago White Sox, DLA Piper, Exelon, Gibsons, Grosvenor Capital Management L.P., Katten Muchin Rosenman LLP, The MacArthur Foundation and the Patrick G. and Shirley W. Ryan Foundation.

Launched in 2005 to commemorate the 50th Anniversary of Richard J. Daley's first inauguration as Mayor of Chicago, the Richard J. Daley forum at UIC is an annual symposium for students, scholars, public officials, civic leaders, policymakers and commentators to discuss important issues and share insights into urban history and urban studies.

Richard J. Daley was first inaugurated as Mayor of Chicago on April 20, 1955. He served as Mayor for more than two decades, during which time he oversaw the rebirth of Chicago's downtown, construction of McCormick Place, development of O'Hare International Airport, and creation of UIC among other notable achievements.

Establishing UIC--originally known as the University of Illinois at Chicago Circle when it opened in 1965--was described by the late mayor as this greatest contribution to the life of the city. Circle Campus merged with the university's Medical Campus in 1982 to form UIC.

UIC is Chicago's largest university with more than 25,000 students, 12,000 faculty and staff, 15 colleges and the state's major public medical center. The campus ranks among the nation's top 50 universities in federal research funding. UIC has more than 145,000 alumni, more than 110,000 of whom live in the Chicago metropolitan area.

A hallmark of UIC is the Great Cities Commitment, through which faculty, students and staff engage with community, corporate, foundation and government partners in hundreds of programs to improve the quality of life in metropolitan areas around the world.

Source: The University of Illinois at Chicago

|GlobalGiants.com|

Edited & Posted by Editor | 12:34 PM | Link to this Post

April 2, 2009

Global Growth Rates Are In Positive Territory: The Conference Board

The Conference Board reports that global output growth in 2009 will be slow but remains positive at 1.3% for 2009. As the G-20 gathers in London, The Conference Board points at large discrepancies in the global economy this year, with advanced economies experiencing a strong contraction in output at -2.5% on average, and emerging economies pulling the world economy along at a reasonable pace of 5.0% on average.

"As projections of global growth have been slashed dramatically recently, we need to remain conscious of the huge uncertainties about how the decline in global trade affects the domestic sectors of emerging economies," says Bart van Ark, Vice President and Chief Economist of The Conference Board. "The internal dynamics of growth created by the millions of consumers in these countries, who have a job or are able to find a job, even in a slowing economy, will continue to generate positive growth." His analysis appears in StraightTalk, a newsletter designed exclusively for members of The Conference Board global business network.

MODEST RECOVERY IN THE U.S. REMAINS LIKELY

Real GDP in the United States is forecasted to fall by -5.9% on an annual rate during the first quarter of 2009, signaling a deep point in the recession. Some better numbers are beginning to emerge. The Conference Board Leading Economic Index and Consumer Confidence Index suggest that the recession will not intensify further. The decline in real consumer spending has leveled off a little. Retail sales, excluding cars and car parts, rose by .7% in February, and some turns in the measures of home sales and prices were also recorded. The Conference Board projects that growth in the second quarter will stay negative and will be very slow in the third quarter, as capital spending will remain low and inventories will not be depleted until year's end. Overall industrial production is also unlikely to move up before the fall. Even the recovery in the fourth quarter will be held back by these negative trends and increased unemployment, which is typically a lagging indicator.

The U.S. may see a contraction in real GDP of -2.6% in 2009 - the largest annual decline since 1946. Nominal output (the value of output that also reflects price change) may actually fall at more than 4%, as disinflation is much more likely in the short run than inflation.

RISK OF A "DOUBLE-DIP" RECESSION

Back-to-back recessions, as occurred between 1980 and 1982 when the economy endured a systemic crisis rather than a regular recessionary period, are a potential risk at this time. Recent increases in commodity prices, on the back of monetary easing and decline in the dollar, are leading to an increase in inflation expectations.

"If the United States experiences a too rapid recovery, there may be a risk of another recession in 2010," cautions Van Ark. "It may fuel expectations for a return to inflation, adding to the uncertainty concerning the pattern and path of economic recovery."

The likelihood of this happening is small as there are three substantial differences between the current crisis and that of the early 1980s: 1) Inflation was the concern then; now the possibility of deflation for the short and medium term is a greater threat. 2) The 1980s crisis was related to a structural transformation of the model of production in the U.S., moving from a manufacturing to a services economy; the current crisis was largely sparked by overleveraged balance sheets and global imbalances in consumption and savings. 3) This time we have massive governmental intervention intended to prevent economic activity from declining even further and stem the rise in unemployment.

LARGE DISCREPANCIES BETWEEN ADVANCED AND EMERGING ECONOMIES

The Conference Board argues that the divergence in growth performance between advanced and emerging economies will create a major challenge to rebalancing the world economy toward a more manageable global distribution of production, consumption and trade in goods and services.

The economies of commodity-producing countries - such as Russia and Brazil - have been producing bad results due to falling energy and commodity prices. China and India are the best bets to limit the global output collapse in 2009. China's export growth engine is under serious stress and the consumer sector will surely be affected by the decline in employment opportunities.

But the internal dynamics of growth created by the millions of consumers who still have a job or are able to find one in a slowing economy will continue to generate positive growth in China. Even though much of the U.S. $586 billion stimulus is likely to have already been baked into the government's investment plans, it may help keep China's growth rate at about 7.5% for 2009, says van Ark.

In India, as well as in several other large economies in the developing world that are somewhat less exposed to the global storm, the impact of the collapse in financial markets on fourth quarter GDP may have done a less lasting damage to the potential for growth this year.

Source: The Conference Board

|GlobalGiants.com|

Edited & Posted by Editor | 11:38 AM | Link to this Post

March 18, 2009

Reputation Risk Management Is on the Rise in U.S. and European Corporations -- The Conference Board

But Many Companies Still Have a Long Way to Go in Protecting Their Reputations.

According to a new report from The Conference Board (global business research and membership organization), a growing number of major global companies are investing substantial resources to manage their reputation risk and have increased their efforts to do so over the last three years.

"Safeguarding reputation is even more critical today because companies have developed successful ways to make reputation risk management part of their overall risk management," says Ellen Hexter, Director, Enterprise Risk Management at The Conference Board and co-author of the report with Sandy Bayer, President of Bayer Consulting. "In addition, different stakeholder groups are becoming more sophisticated in how they drive corporate reputations. Critics on the Internet can now transmit their opinions and complaints around the world with ease. Most importantly, consumers have high expectations that companies will not only produce quality products and services, but also will act ethically in their creation and distribution."

The report defines reputation as how a company is perceived by each of its stakeholder groups and reputation risk as the risk that an event will negatively influence stakeholder perceptions. Many reputation risks are the secondary result of other, more traditionally recognized risks. For example, if a manufacturer produces an unsafe product, it may lose customers and is likely to suffer financial costs due to a product recall, both of which impact reputation. Reputations may be damaged for any number of reasons, including that stakeholders perceive a company to be unethical.

"Although reputation is the quintessential intangible asset, a strong corporate reputation yields concrete benefits - higher market value, stronger sales, and an increased ability to hire the best and the brightest," says Bayer.

The report is based on the findings of The Conference Board Reputation Risk Research Working Group and a survey of 148 risk management executives of major corporations. More than three quarters of the respondents to the survey said their companies are making a substantial effort to manage reputation risk (82 percent) and they have increased focus in this area over the last three years (81 percent).

Other key findings of the study:

• Reputation risk should be managed throughout the organization. Although communication is of critical importance in responding to a risk event, a company's reputation should be considered during the preparation and execution of strategy and new projects, which hasn't been the case in most companies.

• Reputation risk is often not incorporated into risk management. Only 49 percent of executives surveyed said that the management of reputation risk was highly integrated with their Enterprise Risk Management (ERM) function or another risk oversight program.

• Assessing reputation risks is a top challenge. Fifty-nine percent indicated that assessing the perceptions and concerns of stakeholders was an extremely or very significant issue, making it the highest-ranked challenge.

• Media monitoring has become more sophisticated. Today, there are tools to assess whether coverage is positive, neutral or negative; the credibility of publications; the prominence of coverage, etc.

• Efforts are being made to quantify the value of reputation. A select group of companies is making progress in this area by working with specialist consulting firms to quantify the impact of reputation on share price.

• Social media are gaining influence, but most companies are ignoring them. Although consumers and investors are increasingly gathering information from blogs, online forums, and social networking sites, only 34 percent of the survey respondents said they extensively monitor such sites, and only 10 percent actively participated in them.

The findings spurred the following recommendations from The Conference Board Research Working Group:

1) Actively involve boards of directors in reputation risk management.

2) Demonstrate to leaders and management teams in business units the impact of their actions on reputation.

3) Integrate reputation risk management with ERM or other risk management programs.

4) Quantify the value of reputation.

5) Use and nurture employees as corporate ambassadors.

"Boards of directors, senior management, and operating management should demonstrate an active commitment to strong reputation management," conclude the authors.

Source: The Conference Board

|GlobalGiants.com|

"Our reputation is more important than the last hundred million dollars."

-- Rupert Murdoch

"From the sublime to the ridiculous there is but one step."

-- Napoleon Bonaparte

Edited & Posted by Editor | 12:59 AM | Link to this Post

March 5, 2009

WALL STREET REPORT: $5 BILLION IN POLITICAL CONTRIBUTIONS BOUGHT WALL STREET FREEDOM FROM REGULATION, RESTRAINT

Steps to Financial Cataclysm Paved with Industry Dollars?

The financial sector invested more than $5 billion in political influence purchasing in Washington over the past decade, with as many as 3,000 lobbyists winning deregulation and other policy decisions that led directly to the current financial collapse, according to a 231-page report issued today by Essential Information and the Consumer Education Foundation.

The report, "Sold Out: How Wall Street and Washington Betrayed America," shows that, from 1998-2008, Wall Street investment firms, commercial banks, hedge funds, real estate companies and insurance conglomerates made $1.725 billion in political contributions and spent another $3.4 billion on lobbyists, a financial juggernaut aimed at undercutting federal regulation. Nearly 3,000 officially registered federal lobbyists worked for the industry in 2007 alone. The report documents a dozen distinct deregulatory moves that, together, led to the financial meltdown. These include prohibitions on regulating financial derivatives; the repeal of regulatory barriers between commercial banks and investment banks; a voluntary regulation scheme for big investment banks; and federal refusal to act to stop predatory subprime lending.

"The report details, step-by-step, how Washington systematically sold out to Wall Street," says Harvey Rosenfield, president of the Consumer Education Foundation, a California-based non-profit organization. "Depression-era programs that would have prevented the financial meltdown that began last year were dismantled, and the warnings of those who foresaw disaster were drowned in an ocean of political money. Americans were betrayed, and we are paying a high price -- trillions of dollars -- for that betrayal."

"Congress and the Executive Branch," says Robert Weissman of Essential Information and the lead author of the report, "responded to the legal bribes from the financial sector, rolling back common-sense standards, barring honest regulators from issuing rules to address emerging problems and trashing enforcement efforts. The progressive erosion of regulatory restraining walls led to a flood of bad loans, and a tsunami of bad bets based on those bad loans. Now, there is wreckage across the financial landscape."

12 Key Policy Decisions Led to Cataclysm

The report concludes that financial deregulation led directly to the current economic meltdown. For the last three decades, government regulators, Congress and the executive branch, on a bipartisan basis, steadily eroded the regulatory system that restrained the financial sector from acting on its own worst tendencies. "Sold Out" details a dozen key steps to financial meltdown, revealing how industry pressure led to these deregulatory moves and their consequences:

1. 1. In 1999, Congress repealed the Glass-Steagall Act, which had prohibited the merger of commercial banking and investment banking.

2. Regulatory rules permitted off-balance sheet accounting -- tricks that enabled banks to hide their liabilities.

3. The Clinton administration blocked the Commodity Futures Trading Commission from regulating financial derivatives -- which became the basis for massive speculation.

4. Congress in 2000 prohibited regulation of financial derivatives when it passed the Commodity Futures Modernization Act.

5. The Securities and Exchange Commission in 2004 adopted a voluntary regulation scheme for investment banks that enabled them to incur much higher levels of debt.

6. Rules adopted by global regulators at the behest of the financial industry would enable commercial banks to determine their own capital reserve requirements, based on their internal "risk-assessment models."

7. Federal regulators refused to block widespread predatory lending practices earlier in this decade, failing to either issue appropriate regulations or even enforce existing ones.

8. Federal bank regulators claimed the power to supersede state consumer protection laws that could have diminished predatory lending and other abusive practices.

9. Federal rules prevent victims of abusive loans from suing firms that bought their loans from the banks that issued the original loan.

10. Fannie Mae and Freddie Mac expanded beyond their traditional scope of business and entered the subprime market, ultimately costing taxpayers hundreds of billions of dollars.

11. The abandonment of antitrust and related regulatory principles enabled the creation of too-big-to-fail megabanks, which engaged in much riskier practices than smaller banks.

12. Beset by conflicts of interest, private credit rating companies incorrectly assessed the quality of mortgage-backed securities; a 2006 law handcuffed the SEC from properly regulating the firms.

Financial Sector Political Money and 3000 Lobbyists Dictated Washington Policy

During the period 1998-2008:

• Commercial banks spent more than $154 million on campaign contributions, while investing $363 million in officially registered lobbying:

• Accounting firms spent $68 million on campaign contributions and $115 million on lobbying;

• Insurance companies donated more than $218 million and spent more than $1.1 billion on lobbying;

• Securities firms invested more than $504 million in campaign contributions, and an additional $576 million in lobbying. Included in this total: private equity firms contributed $56 million to federal candidates and spent $33 million on lobbying; and hedge funds spent $32 million on campaign contributions (about half in the 2008 election cycle).

The betrayal was bipartisan: about 55 percent of the political donations went to Republicans and 45 percent to Democrats, primarily reflecting the balance of power over the decade. Democrats took just more than half of the financial sector's 2008 election cycle contributions, the report clarifies.

According to the report, the financial sector buttressed its political strength by placing Wall Street expatriates in top regulatory positions, including the post of Treasury Secretary held by two former Goldman Sachs chairs, Robert Rubin and Henry Paulson.

Financial firms employed a legion of lobbyists, maintaining nearly 3,000 separate lobbyists in 2007 alone, says the report.

These companies drew heavily from government in choosing their lobbyists. Surveying 20 leading financial firms, "Sold Out" finds 142 of the lobbyists they employed from 1998-2008 were previously high-ranking officials or employees in the Executive Branch or Congress.

Essential Information is a Washington, D.C. nonprofit that seeks to curb excessive corporate power. The Consumer Education Foundation is a California-based nonprofit that supports measures to prevent losses to consumers.

Source: Essential Information

|GlobalGiants.com|

Click HERE for a full PDF copy of "Sold Out: How Wall Street and Washington Betrayed America".

"Information is the currency of democracy."

-- Thomas Jefferson

"As a very important source of strength and security, cherish public credit. One method of preserving it is, to use it as sparingly as possible; avoiding occasions of expense by cultivating peace, but remembering also that timely disbursements to prepare for danger frequently prevent much greater disbursements to repel it; avoiding likewise the accumulation of debt, not only by shunning occasions of expense, but by vigorous exertions in time of peace to discharge the debts, which unavoidable wars may have occasioned, not ungenerously throwing upon posterity the burthen, which we ourselves ought to bear."

-- GEORGE WASHINGTON, Farewell Address, Sep. 17, 1796

"The government, which was designed for the people, has got into the hands of the bosses and their employers, the special interests. An invisible empire has been set up above the forms of democracy."

-- Woodrow Wilson

"In politics... never retreat, never retract... never admit a mistake."

-- Napoleon Bonaparte

Edited & Posted by Editor | 5:56 AM | Link to this Post

February 21, 2009

Media Seen as the Primary Cause of the Depth and Length of the Global Recession, According to New Research From Frost & Sullivan

Companies Must Ignore Fear, Make Smart Moves to Emerge Stronger.

In a recent survey conducted by Frost & Sullivan, the Growth Partnership Company, 91% of CEOs blame the breadth and depth of the current economic situation on the media.

"The media's manipulation of statistics, negativity, exaggeration, and doomsday forecasts have driven fear and panic among consumers and businesses alike," says David Frigstad, Chairman of Frost & Sullivan.

According to Frost & Sullivan, "Economic statistics are often twisted and exaggerated. The fear of total economic collapse is perpetuated in the media to grab attention and sell more copies or attract more viewers or listeners. Because of this, consumers and business have frozen spending, canceled projects, sold investments, and laid off workers. This has caused a downward spiral in demand and pricing that has now caused about 20 trillion dollars of damage globally."

"As the media continues to perpetuate fear, uncertainty and doubt, there is a growing chance that it will result in a self-fulfilling prophecy," adds Frost & Sullivan Economist Sandeep Maheshwari.

"What clearly started out with financial mismanagement and fraud on Wall Street has now escalated into a major global recession exacerbated by the media," says Frost & Sullivan's research. "CEOs cite how the media has continued to drive fear through efforts to gain more readers, viewers, and listeners. The ironic turn is that the media is also being victimized by the current recession, with declining audiences and falling ad revenues."

In the responses portion of the study, CEOs made several interesting comments:

• "Several newspapers have compared the overall job losses to the Great Depression without taking into account the huge increase in U.S. population since that time. These comparisons only generate more fear and are counter-productive."

• "Economists miss every turn in the economy. Why do we rely on their forecasts today when they are so unreliable? They move like a herd of antelope -- their current forecasts all fit nicely into a pack."

• "I recently read a headline that said Microsoft will lay off 5,000 workers. At the end of the piece it mentioned it would be over a three year period. Compared to the overall size of Microsoft, this is not newsworthy."