January 26, 2013

World Economic Forum Annual Meeting 2013

Photo: The Logo of the World Economic Forum is seen at the congress centre at the Annual Meeting 2013 in Davos, Switzerland, January 22, 2013. (Photo © Remy Steinegger/World Economic Forum).

Photo: Aerial view of the alpine city Davos, Switzerland, where the World Economic Forum Annual Meeting 2013 is taking place January 23 - 27, 2013. (Photo © Andy Mettler/World Economic Forum).

Photo: Ulrike M. Malmendier, Professor of Economics, Department of Economics, and Professor of Finance, Haas School of Business, University of California, Berkeley, USA, gives a speech during the session ‘From Tribalism to Globalism: The Evolution of Human Cooperation’ at the Annual Meeting 2013 of the World Economic Forum in Davos, Switzerland, January 25, 2013. (Photo © Mirko Ries/World Economic Forum).

The 43rd World Economic Forum Annual Meeting is taking place from 23 to 27 January under the theme Resilient Dynamism. More than 2,500 participants from over 100 countries are taking part in the Meeting. Participants include nearly 50 heads of state or government and more than 1,500 business leaders from the Forum’s 1,000 Member companies, as well as Social Entrepreneurs, Global Shapers, Young Global Leaders and representatives from civil society, media, academia and the arts.

Speaking at the Annual Meeting, Shimon Peres, President of Israel, said the world is becoming ungovernable. “Governments have found themselves unemployed because the economy has become global while governments remain national,” he said.

Peres described his view that global companies are replacing the role of governments. “Forty global companies have more fortune than all the governments in the world,” he pointed out.

The co-chairs of Annual Meeting 2013 are: Frederico Curado, President and Chief Executive Officer, EMBRAER, Brazil; Muhtar A. Kent, Chairman of the Board and Chief Executive Officer, The Coca-Cola Company, USA; Huguette Labelle, Chair, Transparency International, Germany; Global Agenda Council on Responsible Mineral Resources Management; Andrew N. Liveris, Chairman and Chief Executive Officer, The Dow Chemical Company, USA; Atsutoshi Nishida, Chairman of the Board, Toshiba Corporation, Japan; and Axel A. Weber, Chairman of the Board of Directors, UBS, Switzerland.

|GlobalGiants.Com|

“Which is the best government? That which teaches us to govern ourselves.”

— Johann Wolfgang von Goethe.

Edited & Posted by the Editor | 4:02 AM | View the original post

September 12, 2012

Universities Need to Reform to Reflect Changing Job Market and Skills Needed

• Universities need to do a better job of cooperating with the corporate world to better prepare students for their careers.

• Young workers are changing companies, forcing companies to adapt.

• An MBA should be carefully considered, as it is not always beneficial.

Photo: Ernesto Zedillo Ponce de Leon, Director, Yale Center for the Study of Globalization, Yale University, USA; World Economic Forum Foundation Board Member; Global Agenda Council on Institutional Governance Systems at the Annual Meeting of the New Champions in Tianjin, China 2012 (© World Economic Forum).

Photo: Rajeev Bhargava, Director and Senior Fellow, Centre for the Study of Developing Societies, University of Delhi, India, at the Annual Meeting of the New Champions in Tianjin, China 2012 (© World Economic Forum).

Photo: Helle Thorning-Schmidt, Prime Minister of Denmark at the Annual Meeting of the New Champions in Tianjin, China 2012 (© World Economic Forum).

As the labour market rapidly changes, universities need to play a stronger role in preparing graduates for life in the workplace, according to a panel on talent development on the second day of the World Economic Forum’s Annual Meeting of New Champions 2012 at Tianjin, People’s Republic of China, 12 September 2012.

“There is a mismatch between where talent is and where it’s needed,” Mark Du Ree, Regional Head, Japan and Asia, and Member of the Executive Committee, Adecco Group, Japan, told participants. “We have very good students who have a great academic career, but we seem to have a disconnect between what’s needed in a corporation and the skills brought to the table.”

N. V. (Tiger) Tyagarajan, President and Chief Executive Officer, Genpact, India, agreed that training the next generation of workers to cope in fast-paced and quickly changing environments is key. He said graduates frequently lack the skills necessary to succeed.

Du Ree added that some universities employ professors or instructors from the corporate world, but many are staffed solely by academics. “What we need to do is have more corporate cooperation with the academics,” he said, noting that young people need to be better prepared. “How can we get academics to spend time in the real world - in the working world - so they know what they’re talking about?” he asked.

Matching talent with demand is another challenge. Ronald Bruder, Founder and Chair, Education For Employment (EFE), USA, a Social Entrepreneur, said that his organization works with employers to find and train talent that meets their needs.

Kevin Taylor, President, Asia-Pacific, BT, Hong Kong SAR, said young workers are also changing the nature of companies. He said young workers are not interested in working seven days a week, or staying up into the early hours of the morning to get their work done. His company has 20,000 employees working from home in the United Kingdom alone. “It’s great,” he said. “The desktop is dead.” He said workers now get their work done anywhere, at any time. According to Taylor, the future will not be how young workers adapt to companies, but how companies can adapt to the working habits and ideals of young workers.

The panellists also tended to agree that an MBA is not as useful as it is perceived to be. Taylor encouraged new graduates to get job experience first, and then pursue an MBA later if it aligns with their career aspirations. Du Ree said he originally planned to pursue his MBA, but, “after working for a few years and finding my passion, I realized I didn’t need it anymore.”

|GlobalGiants.Com|

Edited & Posted by the Editor | 8:38 AM | View the original post

September 7, 2012

World Economic Forum releases The Global Competitiveness Report 2012-2013

• Competitiveness gap widening among European countries

• US remains world’s innovation powerhouse despite decline in overall ranking

• People’s Republic of China most competitive among large emerging markets; India, Russia fall

Photo: Aerial view of the congress center of Davos, Switzerland, where the World Economic Forum Annual Meeting 2012 took place January 25 - 29, 2012 (© World Economic Forum/Andy Mettler).

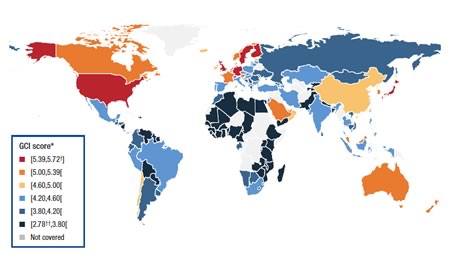

Switzerland, for the fourth consecutive year, tops the overall rankings in The Global Competitiveness Report 2012-2013, released by the World Economic Forum.

Singapore remains in second position and Finland in third position, overtaking Sweden (4th). These and other Northern and Western European countries dominate the top 10 with the Netherlands (5th), Germany (6th) and United Kingdom (8th). The United States (7th), Hong Kong (9th) and Japan (10th) complete the ranking of the top 10 most competitive economies.

The large emerging market economies (BRICS) display different performances. Despite a slight decline in the rankings of three places, the People’s Republic of China (29th) continues to lead the group. Of the others, only Brazil (48th) moves up this year, with South Africa (52nd), India (59th) and Russia (67th) experiencing small declines in rankings.

Despite growing its overall competitiveness score, the United States continues its decline for the fourth year in a row, falling two more places to seventh position. According to the report, in addition to the burgeoning macroeconomic vulnerabilities, some aspects of the country’s institutional environment continue to raise concern among business leaders, particularly the low public trust in politicians and a perceived lack of government efficiency. On a more positive note, the country still remains a global innovation powerhouse and its markets work efficiently, the report says.

The report indicates that Switzerland and countries in Northern Europe have been consolidating their strong competitiveness positions since the financial and economic downturn in 2008. On the other hand, countries in Southern Europe, i.e. Portugal (49th), Spain (36th), Italy (42nd) and particularly Greece (96th) continue to suffer from competitiveness weaknesses in terms of macroeconomic imbalances, poor access to financing, rigid labour markets and an innovation deficit.

Behind Singapore, several Asian economies are performing strongly, with Hong Kong SAR (9th), Japan (10th), Taiwan, China (13th) and the Republic of Korea (19th) all in the top 20.

In the Middle East and North Africa, Qatar (11th) leads the region while Saudi Arabia remains among the top 20 (18th). The United Arab Emirates (24th) improves its performance while Kuwait (37th) slightly declines. Morocco (70th) and Jordan (63rd) improve slightly. In sub-Saharan Africa, South Africa (52nd) and Mauritius (54th) feature in the top half of the rankings.

In Latin America, Chile (33rd) retains the lead and a number of countries see their competitiveness improve, such as Panama (40th), Brazil (48th), Mexico (53rd) and Peru (61st).

“Persisting divides in competitiveness across regions and within regions, particularly in Europe, are at the origin of the turbulence we are experiencing today, and this is jeopardizing our future prosperity.” said Klaus Schwab, Founder and Executive Chairman, World Economic Forum. “We urge governments to act decisively by adopting long-term measures to enhance competitiveness and return the world to a sustainable growth path.”

|GlobalGiants.Com|

Edited & Posted by the Editor | 12:24 PM | View the original post

January 29, 2012

World Economic Forum Annual Meeting 2012 — The Great Transformation: Shaping New Models

Photo: Aerial view of the mountain resort Davos, Switzerland where the World Economic Forum Annual Meeting 2012 took place. © World Economic Forum / Andy Mettler.

Photo: John W. Hickenlooper, Governor of Colorado, USA, is captured during the Open Forum session ‘Water: Scarcity and Stress’ at the Annual Meeting 2012 of the World Economic Forum at the Swiss Alpine High School (SAMD) in Davos, Switzerland, January 28, 2012. © World Economic Forum / Michael Wuertenberg.

Photo: Lael Brainard, US Undersecretary of the Treasury for International Affairs is seen before the session ‘Fixing Capitalism’ at the Annual Meeting 2012 of the World Economic Forum at the congress centre in Davos, Switzerland, January 27, 2012. © World Economic Forum / Sebastian Derungs.

Photo: Josef Ackermann, Chairman of the Management Board and Group Executive Committee, Deutsche Bank, Germany; Foundation Board Member, gestures during the session ‘Trust and the Social Contract’ at the Annual Meeting 2012 of the World Economic Forum at the congress centre in Davos, Switzerland, January 28, 2012. © World Economic Forum / Monika Flueckiger.

Photo: Bob Diamond, Chief Executive, Barclays, United Kingdom is captured during the session ‘Building Trust’ at the Annual Meeting 2012 of the World Economic Forum at the congress centre in Davos, Switzerland, January 27, 2012. © World Economic Forum / Moritz Hager.

Photo: John Donahoe, President and Chief Executive Officer, eBay, USA is captured during the session ‘Digital Norms’ at the Annual Meeting 2012 of the World Economic Forum at the congress centre in Davos, Switzerland, January 28, 2012. © World Economic Forum / Moritz Hager.

Photo: Chander Prakash Gurnani, Chief Executive Officer, Mahindra Satyam, India is captured during the session ‘Leadership Models across Generations’ at the Annual Meeting 2012 of the World Economic Forum at the congress centre in Davos, Switzerland, January 28, 2012. © World Economic Forum / Monika Flueckiger.

Photo: Sheryl Sandberg, Chief Operating Officer, Facebook, USA; Co-Chair of the World Economic Forum Annual Meeting 2012; Young Global Leader is captured during the session ‘Women as the Way Forward’ at the Annual Meeting 2012 of the World Economic Forum at the congress centre in Davos, Switzerland, January 27, 2012. © World Economic Forum / Moritz Hager.

Photo: Han Jian, Associate Professor of Management, China Europe International Business School (CEIBS), People’s Republic of China is captured at the session ‘New Leadership Models from China with the China Europe International Business School (CEIBS)’ at the Annual Meeting 2012 of the World Economic Forum at the congress centre in Davos, Switzerland, January 27, 2012. © World Economic Forum / Remy Steinegger.

Photo: Doug McMillon, President and Chief Executive Officer, Wal-Mart International, Wal-Mart Stores, USA addresses the audience during the session ‘The Global Growth Context’ at the Annual Meeting 2012 of the World Economic Forum at the congress centre in Davos, Switzerland, January 25, 2012. © World Economic Forum / Moritz Hager.

With record participation of over 2,600 leaders from government, academia, business and civil society, the theme of this year’s World Economic Forum Annual Meeting was The Great Transformation: Shaping New Models.

The Co-Chairs of the World Economic Forum Annual Meeting 2012 were: Yasuchika Hasegawa, President and Chief Executive Officer, Takeda Pharmaceutical, Japan; Vikram Pandit, Chief Executive Officer, Citi, USA; Paul Polman, Chief Executive Officer, Unilever, United Kingdom; Alejandro Ramirez, Chief Executive Officer, Cinepolis, Mexico; Sheryl Sandberg, Chief Operating Officer, Facebook, USA; and Peter Voser, Chief Executive Officer, Royal Dutch Shell, Netherlands.

The Meeting closed today, with business leaders urging resolute action to promote growth and employment.

|GlobalGiants.Com|

Edited & Posted by the Editor | 11:33 AM | View the original post

January 30, 2011

World Economic Forum Annual Meeting at Davos, Switzerland: Business Leaders Point to Key Risks Facing Global Economy

• Asset bubbles in emerging markets, soaring commodity prices, state debt are key risks.

• World’s financial system is in better shape than three years ago.

• No consensus on how to tackle high state debt.

Photo: Aerial Photo of Davos, the biggest tourism metropolis of the Swiss alps, captured before the opening of the Annual Meeting 2011 of the World Economic Forum in Davos, Switzerland, January 17, 2011. Davos is in the middle of Swiss Alps and the city for holidays, sports, congresses, health, development and culture. © World Economic Forum/Andy Mettler.

Photo: Oriana Bandiera, Professor of Economics, London School of Economics and Political Science, United Kingdom, is captured during the ‘IdeasLab with the London School of Economics: Doing Better with Less’ at the Annual Meeting 2011 of the World Economic Forum in Davos, Switzerland, January 26, 2011. © World Economic Forum/Jolanda Flubacher.

Photo: Daniel Goleman, Co-Director, Consortium for Research on Emotional Intelligence in Organizations, Rutgers University, USA, speaks during the session ‘The New Reality of Consumer Power’ at the Annual Meeting 2011 of the World Economic Forum in Davos, Switzerland, January 27, 2011. © World Economic Forum/Michael Wuertenberg.

Photo: Om Prakash Bhatt, Chairman, State Bank of India, India, speaks during the session ‘Redeploying Development Finance’ at the Annual Meeting 2011 of the World Economic Forum in Davos, Switzerland, January 28, 2011. © World Economic Forum/Moritz Hager.

Photo: Timothy F. Geithner, US Secretary of the Treasury is captured during the session ‘Priorities for the US Economy’ at the Annual Meeting 2011 of the World Economic Forum in Davos, Switzerland, January 28, 2011. © World Economic Forum/Moritz Hager.

Photo: William H. Gates III, Co-Chair, Bill & Melinda Gates Foundation, USA, speaks during the session ‘Polio: Eradicating an Old Reality Once and for All’ at the Annual Meeting 2011 of the World Economic Forum in Davos, Switzerland, January 28, 2011. © World Economic Forum/Moritz Hager.

Photo: Chanda Kochhar, Managing Director and Chief Executive Officer, ICICI Bank, India; Co-Chair of the World Economic Forum Annual Meeting 2011, is captured during the session ‘The Global Agenda in 2011’ at the Annual Meeting 2011 of the World Economic Forum in Davos, Switzerland, January 30, 2011. © World Economic Forum/Sebastian Derungs.

Photo: Francis Gurry, Director-General, World Intellectual Property Organization (WIPO), Geneva; Global Agenda Council on the Intellectual Property System, is captured during the session ‘The Davos Debrief: Policy Priorities’ at the Annual Meeting 2011 of the World Economic Forum in Davos, Switzerland, January 30, 2011. © World Economic Forum/Sebastian Derungs.

• Top business leaders see a host of potential dangers facing the world economy - ranging from asset bubbles in emerging market countries to soaring world commodity prices and huge levels of state debt in Europe. However, it is difficult to say just where the next global shock will come from.

On the question of continuing low borrowing costs and cheap money in the most-developed economies, one of the factors that contributed to the global economic crash, participants said that they are confident that the lessons have been learnt and that the global banking system has emerged stronger from the test.

“I am a little optimistic. I think that we have a stronger system than three years ago,” James Dimon, Chairman and Chief Executive Officer of JP Morgan & Chase, said during a debate on whether the world is now better prepared to face a future systemic shock.

But, business leaders were divided on how to approach the issue of huge state debt built up by some European countries during the boom years.. Some saw the need for Europe’s stronger economies, particularly Germany, to take part of the load by supporting, for example, the launch of European Union-backed Eurobonds in support of weaker economies, such as Ireland and Greece.

But Dimon warned that any “socializing” of states’ debts, by involving other European Union countries in financing them, could send out the wrong message on the need for fiscal discipline. “You have got to make sure that some are not piggy-backing on others,” he said.

|GlobalGiants.Com|

“Thought, not money, is the real business capital, and if you know absolutely that what you are doing is right, then you are bound to accomplish it in due season.”

— Harvey S. Firestone.

“It is not by augmenting the capital of the country, but by rendering a greater part of that capital active and productive than would otherwise be so, that the most judicious operations of banking can increase the industry of the country.”

— Adam Smith.

Edited & Posted by the Editor | 7:48 AM | View the original post

September 12, 2010

Investment and Enterprise Responsibility Review: UNCTAD report calls for upgraded corporate social responsibility practices to protect public interest

• World Investment Forum of the United Nations Conference on Trade and Development (UNCTAD) has just concluded in Xiamen, China.

• Welcoming more than 1,800 participants, including 460 senior officials from 120 countries, the UNCTAD Secretary General, Dr Supachai Panitchpakdi officially opened the Forum, pointing to the distinctive status of the World Investment Forum 2010 as the key international event of the investment community involving global leaders, senior policy-makers, corporate executives, investors, investment promotion agencies, and investment experts from all over the world.

Transnational corporations (TNCs) play an ever more important role in sustainable development as conduits of capital, technology, and management know-how. Increasingly, TNCs are being called upon to address broader Environmental, Social and Governance (ESG) issues. At the same time large globally active investment institutions are becoming increasingly aware of the potential impact of a range of non-financial issues (e.g. climate change, human rights, corporate governance practices) on an investment proposition.

The World Investment Forum (WIF) is the global forum on investment and development issues organized by the United Nations Conference on Trade and Development (UNCTAD). Held biennially, the forum aims to strengthen international cooperation in the interest of promoting international investment and its contribution to economic growth and development.

WIF 2010 brings together all investment stake-holders, including governments, businesses, international organizations, investment promotion agencies (IPAs), civil society, and international investment experts and practitioners from across the world.

Organized by UNCTAD in partnership with the Ministry of Commerce of China, WIF 2010 is supported by a range of international partners and sponsors, including the World Association of Investment Promotion Agencies, the International Chamber of Commerce, the United Nations Global Compact and the Principles for Responsible Investment.

• There, UNCTAD presented its "Investment and Enterprise Responsibility Review".

This Review, the first of its kind, finds that the world's largest Transnational Corporations (TNCs) and private investment institutions frequently publish information on their social and environmental polices, but that there is wide variation in how such firms and institutions adopt, implement, and report on such matters, undermining the comparability and usefulness of the information.

The study recommends that corporate reporting and investor responsibility standards be upgraded to ensure the public interest is being served.

This review of the current state of practices in the area of Corporate Social Responsibility (CSR) among the world's 100 largest TNCs and Responsible Investment (RI) among the 100 largest institutional investors reveals a number of important insights:

1. Private policy at a large enough scale can have an impact similar to, or greater than, public policy. As a result, CSR has emerged as an important area of soft law self-regulation (or 'soft-regulation'). CSR can present policy makers with new options and tools for addressing key development challenges.

2. Most large TNCs now recognise the importance of CSR yet the standard of communication varies widely. There is a role for policy makers to enhance the quality of communications. Various policy options exist such as supporting the harmonization of CSR reporting, and mandating such standardized reporting through stock exchange listing requirements.

3. Responsible investment practices (efforts by investors to incorporate ESG issues into investment decisions and to engage with investee companies to encourage ESG practices) have become common features of the world's 100 largest pension funds. Regulators can work to strengthen the mechanisms through which institutional shareholders are able to influence the ESG practices of the companies in which they invest, while also encouraging investors to formally articulate their stance on ESG issues in public reports.

4. At least basic climate change related information is now reported by most large TNCs. However significant inconsistencies and inadequacies among company reports undermine the comparability and usefulness of this information. Unless reporting is produced in a consistent and comparable manner, it is difficult for policy makers, investors and other stakeholders to use it to make informed decisions. Policy makers could promote an internationally harmonized approach to the way companies explain, calculate and define climate change related emissions.

5. A number of voluntary initiatives are taking a leading role in designing and facilitating CSR and responsible investment instruments, encouraging improved corporate communication on ESG issues and creating important benchmarks, based on universally agreed principles. Policy makers can become involved in these initiatives with the aims of promoting sustainable development goals and identifying useful tools to complement government rules.

• Meanwhile, World Economic Forum has released its Global Competitiveness Report 2010-2011. Switzerland tops the overall rankings. The United States falls two places to fourth position, overtaken by Sweden (2nd) and Singapore (3rd).

Photo: Peter Brabeck-Letmathe, Chairman of the Board, Nestle, Switzerland; Member of the Foundation Board of the World Economic Forum; Global Agenda Council on Water Security, speaks during the session 'Rebuilding Water Management' in the Congress Centre of the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 30, 2010 (© World Economic Forum/Remy Steinegger.

Photo: Yvan Allaire, Chair of the Board of Directors, Institute for Governance of Public and Private Organizations (IGOPP), Canada; Global Agenda Council on the Role of Business, speaks during the session 'Rethinking Values in the Post-Crisis World' at the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 27, 2010 (© World Economic Forum/Remy Steinegger).

Photo: Queen Rania Al Abdullah, H.M. Queen Rania Al Abdullah of the Hashemite Kingdom of Jordan; Member of the Foundation Board of the World Economic Forum; Global Agenda Council on Education Systems captured during the session 'Rebuilding Education for the 21st Century' at the congress centre at the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 30, 2010. (© World Economic Forum/ Michael Wuertenberg).

According to the WEF report, in addition to the macro-economic imbalances that have been building up over time, there has been a weakening of the United States' public and private institutions, as well as lingering concerns about the state of its financial markets. The Nordic countries continue to be well positioned in the ranking, with Sweden, Finland (7th) and Denmark (9th) among the top 10, and with Norway at 14th. Sweden overtakes the US and Singapore this year to be placed 2nd overall. The United Kingdom, after falling in the rankings over recent years, moves back up by one place to 12th position.

The People's Republic of China (27th) continues to lead the way among large developing economies, improving by two more places this year, and solidifying its place among the top 30. Among the three other BRIC economies, Brazil (58th), India (51st) and Russia (63rd) remain stable. Several Asian economies perform strongly, with Japan (6th) and Hong Kong SAR (11th) also in the top 20. In Latin America, Chile (30th) is the highest ranked country, followed by Panama (53rd) Costa Rica (56th) and Brazil.

Several countries from the Middle East and North Africa region occupy the upper half of the rankings, led by Qatar (17th), Saudi Arabia (21st), Israel (24th), United Arab Emirates (25th), Tunisia (32nd), Kuwait (35th) and Bahrain (37th), with most Gulf States continuing their upward trend of recent years. In sub-Saharan Africa, South Africa (54th) and Mauritius (55th) feature in the top half of the rankings, followed by second-tier best regional performers Namibia (74th), Botswana (76th) and Rwanda (80th).

• View All Countries Rankings in the Global Competitiveness Report 2010-2011

• The World Economic Forum, based in Geneva, Switzerland, is an independent international organization committed to improving the state of the world by engaging leaders in partnerships to shape global, regional and industry agendas.

• While the United Nations Conference on Trade and Development (UNCTAD) is a permanent intergovernmental body. It is the principal organ of the United Nations General Assembly dealing with trade, investment, and development issues. UNCTAD has 193 member States and is headquartered in Geneva, Switzerland.

|GlobalGiants.Com|

Edited & Posted by the Editor | 1:01 PM | View the original post

August 26, 2010

Private Investment in Infrastructure

• How can governments meet ballooning infrastructure investment needs while still cutting costs following the economic crisis? A major part of the solution lies in increasing private sector investment to meet the funding gap, finds a World Economic Forum report released today in Geneva, Switzerland.

Photo: Eric Schmidt, Chairman of the Executive Committee and Chief Executive Officer, Google, USA; Co-Chair of the World Economic Forum Annual Meeting 2010 talks during the session 'Technology for Society' at the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 29, 2010 in the Congress Centre. (© World Economic Forum. Photo by Andy Mettler.)

Photo: Ellen Kullman, Chair of the Board and Chief Executive Officer, DuPont, USA, speaks during the session 'Rethinking How to Feed the World' in the Congress Centre at the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 29, 2010. (© World Economic Forum. Photo by Remy Steinegger.)

Photo: Mark Mactas, President and Chief Operating Officer, Towers Watson, USA is captured during the session 'Rethinking Compensation Models' at the congress centre of the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 27, 2010. (© World Economic Forum. Photo by Michael Wuertenberg.)

• Of the estimated US$ 3 trillion needed per annum to meet global infrastructure investment needs, only US$ 1 trillion currently comes from private sources. A third of total funding needs is in developing countries, where private infrastructure finance is less developed.

The report, Paving the Way: Maximizing the Value of Private Finance in Infrastructure, provides a common reference point for what considerations are important to private capital providers and how the public sector can develop its capacity to address them.

Written through active consultation with representatives from both the public and private sectors, the report provides a framework for policy-makers as they seek to create environments favorable to investment, develop meaningful scale for private investment markets, and prepare for the future evolution of these markets. Case studies highlight what approaches have and have not worked across different countries.

Photo: Levin Zhu, President and Chief Executive Officer, China International Capital Corporation, People's Republic of China captured during the session 'Wanted: Capital' at the congress centre at the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 29, 2010. (© World Economic Forum. Photo by Michael Wuertenberg.)

Photo: Patricia A. Woertz, Chairman, President and Chief Executive Officer, Archer Daniels Midland (ADM), USA; Co-Chair of the Governors Meeting for Consumer Industries 2010; Co-Chair of the World Economic Forum Annual Meeting 2010, speaks during the session 'Rethinking How to Feed the World' in the Congress Centre at the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 29, 2010. (© World Economic Forum. Photo by Remy Steinegger.)

Photo: Anand G. Mahindra, Vice-Chairman and Managing Director, Mahindra & Mahindra, India, captured during the session 'Will India Meet Global Expectations?' at the Congress Centre at the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 28, 2010. (© World Economic Forum. Photo by Sebastian Derungs.)

• Tony Poulter, Global Consulting Leader at PricewaterhouseCoopers, said: "Getting infrastructure investment in place quickly while also delivering value poses a challenge not only to government but to developers, investors and funders. In the current environment this challenge is bigger and more important than ever before. This report from the World Economic Forum shows that the way forward needs to involve new thinking by all parties - but that positive steps can be taken."

The market trends and key factors associated with successfully involving private finance highlighted in the report include:

• Countries that have been successful in tapping private finance markets have:

- created political, legal and economic environments conducive to investment,

- established ongoing programmes of opportunities,

- instituted contractual and regulatory frameworks to address any issues effectively and fairly,

- provided forums for stakeholders to share experiences, and

- involved the public at all stages.

• The costs and terms of commercial debt have changed significantly as a result of the economic crisis; reinvigorating the capital markets as a source of finance for infrastructure is difficult but of critical importance in the long term.

• There will be a move to more specialized infrastructure funds to provide investors with a better alignment of risk to reward. Investors will also place greater value on fund managers with experience in ongoing infrastructure asset management.

• Retail finance participation in infrastructure funds is likely to grow, but it requires a clear articulation of the value proposition and related challenges.

• Not all pension funds are the same and, while some are undoubtedly major investors in infrastructure, there are many that still regard infrastructure to be too specialized an alternative investment.

• While the heightened government financial support of infrastructure through the current financial crisis is expected to diminish, it appears likely that more countries will set up state infrastructure banks.

• Budgetary issues and increasingly constrained opportunities in the developed world may help steer more investment dollars to emerging economies (particularly BRIC countries) that have increasingly stable political, legal and economic regimes.

• Private investors care more about whether an investment is based on established practices than if it is green field. Getting private financing remains a challenge when the project is novel, untested or in a new market, but there have been successful examples of investment in more challenging projects in different markets.

Photo: Orit Gadiesh, Chairman, Bain & Company, USA; Member of the Foundation Board of the World Economic Forum captured during the session 'The Gender Agenda: Putting Parity into Practice' at the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 30, 2010 in the Congress Centre. (© World Economic Forum. Photo by Sebastian Derungs.)

Photo: Melinda French Gates, Co-Chair, Bill & Melinda Gates Foundation, USA; Co-Chair of the World Economic Forum Annual Meeting 2010, speaks during the 'Bill & Melinda Gates Foundation Pledge' in the Congress Centre of the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 29, 2010 . (© World Economic Forum. Photo by Sebastian Derungs.)

Photo: Doris Leuthard, (L) President of the Swiss Confederation and Federal Councillor of Economic Affairs shakes hands with the President of France Nicolas Sarkozy (R), at the congress centre prior to the 'Opening Plenary of the World Economic Forum Annual Meeting 2010' of the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 27, 2010. (© World Economic Forum. Photo by Michael Wuertenberg.)

The report is the result of a year-long collaboration between the World Economic Forum, PricewaterhouseCoopers and Industry Partners of the World Economic Forum. Guidance was provided by an Expert Committee of 24 leading practitioners from the private and public sectors and academics.

The Report Expert Committee:

• Cressida Hogg, Managing Partner, Infrastructure, 3i Group.

• Robbert Coomans, Advisor to the Board, APG Investments.

• Mustafa Abdel-Wadood, Managing Director and Chief Executive Officer, Abraaj Investment Management.

• Michael Till, Partner and Co-Head, Infrastructure, Actis.

• Hela Cheikhrouhou, Division Manager, Infrastructure Finance, African Development Bank.

• Rajat M. Nag, Managing Director General, Asian Development Bank.

• Graeme Bevans, Vice-President and Head of Infrastructure, CPP Investment Board.

• Stephen Vineburg, Chief Executive Officer, Infrastructure, CVC Capital Partners.

• Hazem Shawki, Managing Partner, EFG-Hermes Private Equity.

• Lennart Blecher, Senior Partner, EQT Partners.

• Pierre Coindreau, Principal Advisor, European PPP Expertise Centre.

• Bayo Ogunlesi, Chairman and Managing Partner, Global Infrastructure Partners.

• Chris Lee, Founder and Managing Partner, Highstar Capital.

• Luis Miranda, President and Chief Executive Officer, IDFC Private Equity.

• Rashad Kaldany, Vice-President, Asia, Eastern Europe, Middle East and North Africa, International Finance Corporation.

• Marc Lipschultz, Global Head Energy and Infrastructure, Kohlberg Kravis Roberts & Co.

• Sadek Wahba, Global Head, Morgan Stanley Infrastructure.

• Samara Barend, Former Executive Director, New York State Commission on State Asset Maximization.

• Stephen Dowd, Senior Vice-President, Infrastructure, Ontario Teachers Plan Pension Board.

• Richard Abadie, Partner, PricewaterhouseCoopers.

• Tony Poulter, Global Consulting Leader, PricewaterhouseCoopers.

• Nick Pitts-Tucker, Former General Manager, Co-Head of Corporate Banking Group and Structured Finance Department, Sumitomo Mitsui Banking Corporation Europe Ltd.

• Ryan Orr, Executive Director, Collaboratory for Research on Global Projects, Stanford University.

• Robert Dove, Managing Director, Infrastructure, The Carlyle Group.

• Polly Trottenberg, Assistant Secretary for Transportation Policy, US Department of Transportation.

• The Report - Paving the Way: Maximizing the Value of Private Finance. GET IT HERE.

|GlobalGiants.Com|

Edited & Posted by the Editor | 11:30 AM | View the original post

May 31, 2010

Everybody's Business: Strengthening International Cooperation in a More Interdependent World

The World Economic Forum today issued one of the most extensive sets of proposals to strengthen international cooperation and governance ever assembled.

• The product of a year-long dialogue and group of task forces involving over 1,500 academic, business, governmental and civil society experts and decision-makers from around the world, the Forum's Global Redesign Initiative report contains 58 specific proposals and nine thematic essays by some of the international community's leading authorities on international economic, environmental and security cooperation.

Entitled Everybody's Business: Strengthening International Cooperation in a More Interdependent World, the Forum's report warns that global severe risks and challenges are accumulating in many areas, and international institutions and arrangements are often ill-equipped to provide a proactive response.

Photo: Brian T. Moynihan, President, and Chief Executive Officer, Bank of America, USA, captured during the session 'Redesigning Capital Markets' at the Congress Centre of the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 29, 2010. (© World Economic Forum. Photo by Michael Wuertenberg).

Photo: Geoff Cutmore (Anchor, CNBC, United Kingdom) captured at the World Economic Forum on Europe held in Brussels, Belgium, May 10, 2010. (© World Economic Forum. Photo by Youssef Meftah).

Photo: William H. Gates III, Co-Chair, Bill & Melinda Gates Foundation, USA, smiles during the 'Bill & Melinda Gates Foundation Pledge' in the Congress Centre of the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 29, 2010. (© World Economic Forum. Photo by Sebastian Derungs).

The report reminds the international community that amid the financial crisis in late 2008 and early 2009, it "was seized with the transformational nature of our times." The report calls on it to "hold on to that moment of possibility, consolidate its considerable accomplishment in containing the crisis and renew its earlier commitment to renovate the international system."

Drawing a parallel to the 1944 Dumbarton Oaks and Bretton Woods conferences that designed much of the post-war international security and economic architecture over a year before World War II ended, the report concludes that the time has come for governments, companies, and other civil society institutions to "rise above their immediate, parochial interests and consider more seriously their long-term stake in a properly structured and resourced global cooperation system for the 21st century."

Forum Managing Director Richard Samans, Executive Chairman and Founder Klaus Schwab and Vice-Chairman Lord Malloch-Brown conclude: "Even as governments develop their exit strategies from fiscal and monetary stimulus measures applied during the crisis, they should engage to absorb the larger meaning of the changes that have transformed the international community."

The Forum report proposes a "blueprint for renovating international cooperation in an era of increasingly complex interdependence, rendering it both more effective and legitimate" based on the many proposals that have emerged from the Global Redesign process.

In particular, it proposes a more results-oriented "multidimensional" approach to international governance and cooperation. The report argues that the international community's increasing interdependence creates new modes and means of accelerating progress on many global challenges. It demonstrates how pragmatic strategies can be combined to achieve breakthroughs on such issues as climate change, fisheries depletion, unemployment and poverty, public health, the proliferation of weapons of mass destruction and educational access, and illiteracy.

Photo: Montek S. Ahluwalia, Deputy Chairman, Planning Commission, India, speaks during the session 'Rethinking Government Assistance' in the Congress Centre of the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 29, 2010. (© World Economic Forum. Photo by Remy Steinegger).

Photo: Lawrence H. Summers, Director, National Economic Council (NEC), Executive Office of the President, USA, is captured during the session 'The US Economic Outlook' at the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 29, 2010. © World Economic Forum. Photo by Monika Flueckiger).

The report calls for the "state-based core of the international system to be adapted to our more complex, bottom-up world in which non-governmental actors have become a more significant force." To this end, it urges governments and international organizations to conceive of themselves more explicitly as constituting part of "a much wider global cooperation system that has the potential to overcome the limitations of scale, information, and coherence."

The report calls for a stronger sense of ownership and responsibility on the part of the non-governmental institutions and their leaders regarding the underlying health of the international system.

• The report criticizes the "severe price the international community has paid for its complacency about systemic financial and macro-economic risks that were well-publicized but allowed to accumulate for too long." It calls on "those who educate and select business, scientific, academic, religious, media as well as political leaders to redesign their curricula and senior talent development and promotion policies to reflect that they are cultivating not only leaders of functional organizations but also stewards of the international system."

In addition to making proposals to strengthen international cooperative structures on problems as diverse as financial stability, international trade, water scarcity, prevention of mass atrocities, Internet security, malnutrition, energy security and many others, the report of the Global Redesign Initiative includes a number of broader proposals for the international community. For example, it:

• Urges the Group of 20 Leaders' process to clarify soon its ongoing purpose and relationship with the United Nations and specialized international organizations. In addition, it challenges these leaders to reach a package deal on the currently deadlocked UN climate, WTO trade, Millennium Development Goal funding, IMF and World Bank reform, and global macro-economic rebalancing negotiations, arguing that this kind of systemic leap forward in international cooperation would yield large net benefits for developing, emerging and advanced countries alike and could only be brokered by G20 leaders.

Photo: Peter Westaway (Chief European Economist, Nomura International Plc, United Kingdom) captured at the World Economic Forum on Europe held in Brussels, Belgium, May 10, 2010. (© World Economic Forum. Photo by Youssef Meftah).

Photo: H.M. Queen Rania Al Abdullah of the Hashemite Kingdom of Jordan; Member of the Foundation Board of the World Economic Forum; Global Agenda Council on Education Systems captured during the session 'Rebuilding Education for the 21st Century' at the congress centre at the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 30, 2010. (© World Economic Forum. Photo by Michael Wuertenberg).

The proposals were developed by the Forum's Global Agenda Councils of leading experts and decision-makers from academia, business, civil society, international organizations and government as well as its Industry Partner communities and Young Global Leader Task Forces.

The proposals were reviewed by the following distinguished rapporteurs, who have written nine thematic summary chapters that set them in broader context and provide additional proposals:

1. Creating a Values Framework - John J. DeGioia, President, Georgetown University, USA.

2. Building Sustained Economic Growth - Robert Z. Lawrence, Albert L. Williams Professor of Trade and Investment, John F. Kennedy School of Government, Harvard University, USA.

3. Strengthening the International Monetary and Financial System - David Daokui Li, Director and Mansfield Freeman Professor of Economics, Center for China in the World Economy (CCWE), Tsinghua University, People's Republic of China; and Suzanne Nora Johnson, Trustee, Carnegie Institution for Science, USA.

4. Creating Employment, Eradicating Poverty and Improving Social Welfare - John McArthur, Chief Executive Officer, Millennium Promise, USA; and Dennis J. Snower, President, Kiel Institute for the World Economy, Germany.

5. Managing and Mitigating Global Risks - Ian Goldin, Director, James Martin 21st Century School, and Professorial Fellow, Balliol College, University of Oxford, United Kingdom.

6. Ensuring Health for All - Peter Piot, Professor and Director, Institute of Global Health, Imperial College London, United Kingdom; David E. Bloom, Clarence James Gamble Professor of Economics and Demography, Harvard School of Public Health, USA; and Peter C. Smith, Professor, Health Policy, Imperial College London, United Kingdom.

7. Enhancing Global Security - Lilia Shevtsova, Senior Associate, Carnegie Endowment for International Peace, Carnegie Moscow Center, Russian Federation; and Jean-Marie Guéhenno, Senior Non-resident Fellow, Brookings Institution, USA.

8. Ensuring Sustainability - Ashok Khosla, Chairman, Development Alternatives, India; and Caio Koch-Weser, Vice-Chairman, Deutsche Bank Group, Deutsche Bank, United Kingdom.

9. Building Effective Institutions in an Empowered Society - Ngaire Woods, Professor of International Political Economy, University of Oxford, United Kingdom; and Kishore Mahbubani, Dean, Lee Kuan Yew School of Public Policy, Singapore.

"If we do not want to get caught in a continuous vicious cycle of crisis-fighting, we have to analyze the fundamental forces changing our world and formulate policies which take into account the manifold structural changes in geopolitics and geo-economics," said Professor Klaus Schwab, Founder and Executive Chairman of the World Economic Forum.

• Global Redesign Initiative Report: GET IT HERE

Source: World Economic Forum

|GlobalGiants.Com|

Edited & Posted by the Editor | 4:35 AM | View the original post

May 19, 2010

International Trade: The Global Enabling Trade Report 2010

• Singapore and Hong Kong are the most open economies to international trade in 2010.

• Vietnam gains 18 positions among 125 countries in The Global Enabling Trade Report 2010.

• Turkey, India and Russia drop in the rankings.

Photo: Victorial Harbour, Hong Kong.

East Asian economies - Singapore and Hong Kong SAR - continue to occupy the top two positions in the Enabling Trade Index ranking, followed by Denmark, Sweden and Switzerland, according to The Global Enabling Trade Report 2010, released today by the World Economic Forum in Geneva.

New Zealand moves by five ranks to 5th place. Norway, Canada, Luxembourg and the Netherlands complete the top-10 list. Iceland enters the ranking for the first time at 11th position, and Finland drops out of the top 10 to 12th place.

Among the large economies, Germany is the best performer at 13th, ahead of the United States, which drops by three places to 19th. China (48th) and Brazil (87th) remain stable, while Turkey (62nd), India (84th) and Russia (114th) drop in the ranking.

The results mirror the resilience against the threat of protectionism during the economic crisis. International agreements such the WTO framework and pledges by the G20 have contributed to limiting the effect of protectionist pressures on trade barriers. Despite fears of rising protectionism, the report confirms that a large majority of countries did not raise trade barriers.

"Just as trade was a key force spreading the growth slowdown internationally, so can trade be an important driver in diffusing the benefits of recovery across the globe. When individual countries enable trade, they provide benefits not only to themselves but also to other nations with which they trade. Improved market access, more efficient customs, and better infrastructure and business environments offer enhanced opportunities for both importers and exporters. Thus, granting Aid for Trade to help nations implement such measures reflects enlightened self-interest, because it enhances welfare in recipient countries and their trading partners," said Robert Z. Lawrence, Albert L. Williams Professor of Trade and Investment at the John F. Kennedy School of Government at Harvard University, USA. Professor Lawrence is also academic adviser and co-editor of the report.

• Published for the third year in a row and covering 125 economies worldwide, the report presents a resource for dialogue and provides a yardstick of the extent to which economies have in place the necessary attributes for enabling trade and where improvements are most needed.

• Get The Global Enabling Trade Report 2010

Source: The World Economic Forum, Geneva, Switzerland.

|GlobalGiants.Com|

Edited & Posted by the Editor | 11:56 PM | View the original post

May 10, 2010

"We will do anything to defend the Euro"

• If Europe wants a monetary union, it must promote an economic union.

• Europe cannot afford its social model without economic growth and increased competitiveness.

Photo: Participants captured at the World Economic Forum on Europe held in Brussels, Belgium, May 10, 2010. © World Economic Forum. Photo by Youssef Meftah.

Photo: Annette Court (Member of the group Executive Committee and Chief Executive Officer, Europe General Insurance Zurich Financial Services, Switzerland) captured at the World Economic Forum on Europe held in Brussels, Belgium, May 10, 2010. © World Economic Forum. Photo by Youssef Meftah.

Photo: José Manuel Barroso (President, European Commission, Brussels) captured at the World Economic Forum on Europe held in Brussels, Belgium, May 10, 2010. © World Economic Forum. Photo by Youssef Meftah.

• The World Economic Forum on Europe opened today (May 10, 2010) in Brussels, Belgium. Over 400 leaders from business, government, academia and civil society from over 40 countries are participating. The meeting is being held from 10 to 11 May under the theme Renewed Leadership, New Vision.

In less than 48 hours, Europe took "a historic decision" to provide an unprecedented rescue package in an effort to combat the debt crisis that has swept across Europe and threatened markets globally.

"We have stated that we will do anything to defend the euro. We completed an agreement to respond in a coordinated, fast and effective manner to any difficulties in Member States. Any attempt to weaken the stability of the euro will fail," said José Manuel Barroso, President, European Commission, Brussels, at the opening plenary of the World Economic Forum on Europe.

Photo: Francine Lacqua (Anchor and Business Reporter, Bloomberg TV, United Kingdom) captured at the World Economic Forum on Europe held in Brussels, Belgium, May 10, 2010. © World Economic Forum. Photo by Youssef Meftah.

After a meeting in Brussels lasting more than 11 hours, the Economic and Finance Council, comprising the EU's economic and finance ministers, reached an agreement in the early hours of Monday morning on a loan package of more than 720 billion euros over three years to defend the euro and to cover the needs of European Member States that, according to Barroso, are "living beyond their means". Stock markets, which fell to near three-month lows last week over rising concerns about debt contagion from Greece, rallied on Monday in response to the substantial emergency loan package from the EU and the International Monetary Fund.

Referring to the bailout package as a "consolidation pact" for the eurozone, Barroso pledged to broaden surveillance of the EU's economic imbalances, reinforce competitiveness and push for a permanent mechanism to deal with economic crises. "If there is one lesson we have learned from this crisis, it is this: if you want a monetary union, you need to promote an economic union. This means reinforced economic governance and respect of all obligations Member States have under the Stability and Growth Pact."

Photo: Chander P. Gurnani (Chief Executive Officer, Mahindra Satyam, India) captured at the World Economic Forum on Europe held in Brussels, Belgium, May 10, 2010. © World Economic Forum. Photo by Youssef Meftah.

Photo: Jeffrey Joerres (Chairman and Chief Executive Officer, Manpower Inc., USA) captured at the World Economic Forum on Europe held in Brussels, Belgium, May 10, 2010. © World Economic Forum. Photo by Youssef Meftah.

Klaus Schwab, Founder and Executive Chairman of the World Economic Forum, praised European leaders for their "great act of European solidarity" and noted that this historical moment represents a "critical juncture" for the future of Europe.

Source: World Economic Forum

|GlobalGiants.Com|

Edited & Posted by the Editor | 2:07 PM | View the original post

March 25, 2010

Global Information Technology Report 2009-2010

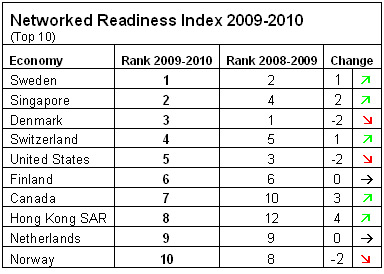

• Sweden replaces Denmark as world's most networked economy in The Global Information Technology Report 2009-2010 rankings.

• United States moves down two positions to fifth place.

• China (37th) and India (43rd) lead BRIC economies and continue upward trend with a 9 and 11 place improvement respectively.

• Ninth edition of report covers 133 economies, accounting for over 98% of world's GDP.

Sweden tops the rankings of The Global Information Technology Report 2009-2010, released today (March 25, 2010) by the World Economic Forum in Geneva, Switzerland.

The report highlights the key role of ICT (Information and Communication Technology) as an enabler of a more economically, environmentally and socially sustainable world in the aftermath of one of the most serious economic crises in decades. Sweden is followed by Singapore and Denmark, which was in the number one position for the last three years.

Photo: An overview captured during the session 'The Global Agenda 2010: The View from Davos' at the Congress Centre of the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 31, 2010. (Copyright by World Economic Forum. swiss-image.ch/Photo by Michael Wuertenberg)

"Sweden, Singapore and Denmark's superior capacity to leverage ICT as an enabler of sustainable, long-term economic growth is built on similar premises, relating with a long-standing focus placed by governments and private sectors alike on education, innovation and ICT access and diffusion," said Irene Mia, Senior Economist of the Global Competitiveness Network at the World Economic Forum and co-editor of the report. "The success of these countries underlines the importance of a joint ICT vision, an implementation, by all the different stakeholders in a society for a country to take full advantage of ICT advances in its daily life and overall competitiveness strategy."

The report is produced by the World Economic Forum in cooperation with INSEAD, the leading international business school, within the framework of the World Economic Forum's Global Competitiveness Network and the Industry Partnership Program for Information Technology and Telecommunications Industries.

Published for the ninth consecutive year with an extensive coverage of 133 economies worldwide, the report remains the world's most comprehensive and authoritative international assessment of the impact of ICT on the development process and the competitiveness of nations.

Under the theme ICT for Sustainability, this year's report explores the many and diverse links between ICT and sustainability, in all its dimensions.

• The Networked Readiness Index: View the Rankings of All Countries

The Networked Readiness Index (NRI), featured in the report, examines how prepared countries are to use ICT effectively on three dimensions:

1. The general business, regulatory and infrastructure environment for ICT.

2. The readiness of the three key stakeholder groups in a society -- individuals, businesses and governments -- to use and benefit from ICT.

3. The actual usage of the latest information and communication technologies available.

The NRI uses a combination of data from publicly available sources, as well as the results of the Executive Opinion Survey, a comprehensive annual survey conducted by the World Economic Forum with its network of partner institutes (leading research institutes and business organizations) in the countries included in the report. The survey provides unique data on many qualitative dimensions important to assess national networked readiness.

• The cross-country analysis of the drivers of networked readiness provides useful comparative information for making business decisions and additional value to governments wishing to improve their ICT preparedness.

The report contains detailed country profiles for the 133 economies featured in the study, providing a snapshot of each economy's level of ICT penetration and usage. Also included is an extensive section of data tables, as well as each indicator used in the computation of the Index.

The editors of the report are Soumitra Dutta, Roland Berger Professor of Business and Technology, INSEAD, France, and Irene Mia, Director and Senior Economist, Global Competitiveness Network, World Economic Forum.

• Get the Entire Global Information Technology Report 2009-2010

Source: The World Economic Forum, Geneva, Switzerland.

|GlobalGiants.Com|

Edited & Posted by the Editor | 1:15 PM | View the original post

February 3, 2010

World Economic Forum Annual Meeting 2010: Rebuilding the Global Economy

Photo: William J. Clinton, Founder, William J. Clinton Foundation; President of the United States (1993-2001); UN Special Envoy to Haiti speaks during the 'Special Session on Haiti' at the Congress Centre at the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 28, 2010. (Copyright by World Economic Forum. swiss-image.ch/Photo by Remy Steinegger)

• At the 40th World Economic Forum Annual Meeting 2010, participants found that the global recovery is fragile, and now is the moment to rethink values as the world rebuilds prosperity.

• All countries in the G20 and beyond should find new pathways to sustainable growth and job creation.

• Concretely, Bill and Melinda Gates, Co-Chairs of the Bill and Melinda Gates Foundation, which is a founding partner of the GAVI Alliance, pledged US$ 10 billion to vaccinate over 8 million children in the next decade.

• Former US President William J. Clinton announced a joint initiative between the World Economic Forum, the Clinton Global Initiative and the UN to support Haiti's long-term reconstruction.

• Canadian Prime Minister Stephen Harper, South Korean President Lee Myung-Bak, Mexican President Felipe de Jesus Calderon Hinojosa and French President Nicolas Sarkozy all set forth agendas for global engagement to prevent future crises and to promote sustainability and principled growth.

• Since its launch 10 years ago, the Global Alliance for Vaccines and Immunisation (GAVI) has saved over 4 million lives and has immunized an additional 256 million children in the world's poorest countries.

Photo: Azim H. Premji, Chairman, Wipro, India; Co-Chair of the World Economic Forum Annual Meeting 2010 captured during the session 'A Roadmap for a Sustainable Recovery' of the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 31, 2010 at the Congress Centre. (Copyright by World Economic Forum. swiss-image.ch/Photo by Sebastian Derungs)

Photo: Josef Ackermann, Chairman of the Management Board and the Group Executive Committee, Deutsche Bank, Germany; Member of the Foundation Board of the World Economic Forum; Chair of the Governors Meeting for Financial Services 2010; Co-Chair of the World Economic Forum Annual Meeting 2010 captured during the session 'A Roadmap for a Sustainable Recovery' of the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 31, 2010 at the Congress Centre. (Copyright by World Economic Forum. swiss-image.ch/Photo by Sebastian Derungs)

Photo: Edward J. Markey, Congressman from Massachusetts (Democrat), 7th District, Chairman, Select Committee on Energy Independence and Global Warming, USA, speaks during the session 'The US Legislative Agenda: A Global Perspective' in the Congress Centre of the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 30, 2010. (Copyright by World Economic Forum. swiss-image.ch/Photo by Michael Wuertenberg)

Photo: Robert Z. Lawrence, Albert L. Williams Professor of Trade and Investment, John F. Kennedy School of Government, Harvard University, USA; Global Agenda Council on Trade is captured during the session 'Rethinking Trade and Climate Change' at the congress centre during the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 30, 2010. (Copyright by World Economic Forum. swiss-image.ch/Photo by Sebastian Derungs)

At the conclusion of the 40th World Economic Forum Annual Meeting in Davos, Switzerland, participants pledged to rethink, rebuild and redesign the global economy based on sustainable principles.

The sense of the Meeting, echoed by Lawrence H. Summers, Director of the US National Economic Council (NEC), was that the world was experiencing "a statistical recovery and a human recession." "We are not out of the woods yet," said Michael Oreskes, Senior Managing Editor of the Associated Press. "The recovery is still very fragile in many developed economies." Principled leadership is key to stabilization.

"At the end, it's an interdependent system," said Josef Ackermann, Chairman of the Management Board and the Group Executive Committee of Deutsche Bank; Member of the Foundation Board of the World Economic Forum; and Co-Chair of the World Economic Forum Annual Meeting 2010. "If you lose the support of society, you are not going to achieve your corporate objectives."

Job creation is critical to sustainable recovery. There is a role for all to play in job creation, underscored Patricia A. Woertz, Chairman, President and Chief Executive Officer of Archer Daniels Midland (ADM), and Co-Chair of the World Economic Forum Annual Meeting 2010. "And retaining jobs is as important as creating new ones." The recession also demonstrated that the world must hear better the voices outside of the G8.

Photo: Ann M. Veneman, Executive Director, United Nations Children's Fund (UNICEF), New York; Global Agenda Council on the Welfare of Children is captured during the session 'Redesign Your Cause' of the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 30, 2010. (Copyright by World Economic Forum. swiss-image.ch/Photo by Monika Flueckiger)

Photo: Sheryl Sandberg, Chief Operating Officer, Facebook Inc., USA captured during the session 'The Gender Agenda: Putting Parity into Practice' at the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 30, 2010. (Copyright by World Economic Forum. swiss-image.ch/Photo by Sebastian Derungs)

Photo: Harold McGraw III, Chairman, President and Chief Executive Officer, The McGraw-Hill Companies, USA during the session 'Rebuilding Education for the 21st Century' at the congress centre at the Annual Meeting 2010 of the World Economic Forum in Davos, Switzerland, January 30, 2010. (Copyright by World Economic Forum. swiss-image.ch/Photo by Michael Wuertenberg)

"The self-confidence of emerging nations is completely different," said Azim H. Premji, Chairman of Wipro, and Co-Chair of the World Economic Forum Annual Meeting 2010. He warned that in India and China "if services are put under severe, unreasonable restrictions, you will get tariffs overnight."

"If you have lost the trust of societies, you cannot just respond technically, you have to respond morally," said Ackermann. Rowan D. Williams, Archbishop of Canterbury, United Kingdom, urged participants to take collective responsibility for the future by being individually responsible now. Living responsibly in the present means living within ecological limits to ensure the security of work and food. "Responsibility for the future means being responsible for a vision of humanity which excites and enlarges us," he added.

Earlier, addressing participants in a session on "The US Legislative Agenda: A Global Perspective" at the World Economic Forum Annual Meeting 2010, US congressmen and senators confirmed that despite bipartisan differences, there is agreement that financial regulation is imperative. So, this spring, expect an energy package and "tough regulation" on financial services from the Obama Administration.

Source: World Economic Forum, Davos, Switzerland

|GlobalGiants.Com|

Edited & Posted by the Editor | 7:04 AM | View the original post

October 8, 2009

World Economic Forum's Financial Development Report shows global financial centres' lead is weakening

• Signs of weakness emerge among many global financial centers following crisis.

• Developing countries show comparative financial stability, but also potential for improvement in other areas.

• Report analyses 55 financial systems and capital markets around the world.

Photos: Participants captured during the Dalian WorkSpace 2009 at the World Economic Forum's Annual Meeting of the New Champions in Dalian, China.

• Financial Development Report 2009 -- New York, USA, 8 October 2009 - The world's largest economies took the biggest hit in the World Economic Forum's second annual Financial Development Report released today.

Global financial centers still lead in the report's Index, but the effects of financial instability have pulled down their scores compared to last year. The United Kingdom, buoyed by the relative strength of its banking and non-banking financial activities, claimed the Index's top spot from the United States, which slipped to third position behind Australia largely due to poorer financial stability scores and a weakened banking sector.

The Financial Development Report ranks 55 of the world's leading financial systems and capital markets. It analyses the drivers of financial system development and economic growth in developed and developing countries to serve as a tool for countries to benchmark themselves and establish priorities for reform.

• Download the 2009 rankings in PDF

• Download the full Report (PDF)

Photos: Participants captured during a session at the Young Global Leaders Summit 2009 in Dalian, China.

The rankings are based on over 120 variables spanning institutional and business environments, financial stability, and size and depth of capital markets, among other factors.

The financial crisis was acutely felt in most global financial systems and caused most countries' scores to drop significantly compared to 2008.

"The change in scores does demonstrate the implications of the downturn on our assessment of the long-term development of financial systems," said Nouriel Roubini of New York University and Chairman, RGE Monitor who is the lead academic on the report.

Germany and France suffered a heavy fall in overall scores that pulled them out of the top 10. They dropped in the rankings but demonstrated financial stability scores that were significantly higher than the United Kingdom and US. Australia showed particular strength this year, a trend that is echoed in many Asia Pacific economies.

The breadth of factors covered in the report means that countries with high financial instability scores like the United Kingdom and US could still achieve a high relative ranking in the Index due to other strengths.

"We hope this report will provide some insight as to how the financial crisis has affected the world's major financial systems. It draws attention to the diversity of factors beyond financial stability that must be addressed to support the role of financial systems in driving economic growth. The United Kingdom and US may still show leadership in the rankings, but their significant drops in score show increasing weakness and imply their leadership may be in jeopardy." said Kevin Steinberg, Chief Operating Officer, World Economic Forum USA.

Some developing countries performed well in the financial stability section of the Index. Chile came in third while Malaysia, Mexico and Brazil are all in the top 15. Norway and Switzerland took the top two spots in this category.

"Developing countries exhibited a relatively strong showing in the financial stability pillar of the Index. For some, this is the result of learning from the mistakes of past financial crises, while for others it may reflect the relative lack of complexity and global integration of their financial systems," said Co-Author Nouriel Roubini.

Developing countries also earned many of the top spots with respect to commercial access, which measures the availability of capital through such means as commercial loans, IPOs and venture capital.

The Industry Partnership Programme of the World Economic Forum, under whose auspices this work was undertaken, provides a platform for the world's leading companies to define and address critical issues. The Financial Development Report benefited from the guidance and support of its Industry Partners with particular contributions from Barclays Capital, EFG Hermes, JPMorgan, Standard Chartered Bank and Troika Dialog.

The report draws on data taken from a variety of publicly available sources such as the World Bank.

Source: World Economic Forum

|GlobalGiants.com|

Edited & Posted by the Editor | 10:32 AM | View the original post

September 13, 2009

New Global Reserve Currency

• The international monetary system needs reform, but so do the Asian and US economies.

According to thought leaders from the principal world economies, the current international monetary system, reliant on the US dollar, is deeply flawed, but a single viable alternative is not readily apparent.

This was the outcome from the debate at the Annual Meeting of the New Champions on September 12, 2009 at Dalian, People's Republic of China, where they discussed the global currency reserve system.

Photo: Participants captured during the Dalian WorkSpace 2009 at the World Economic Forum's Annual Meeting of the New Champions in Dalian, China 10-12 September 2009. © World Economic Forum.

Photo: Participants gather at the Education for the Next Wave of Growth session at The World Economic Forum Annual Meeting of the New Champions in Dalian, China 10-12 September 2009. © World Economic Forum.

Photo: Michael D. Antonovich, Los Angeles County Supervisor, speaks during the North America's Economic Outlook session at The World Economic Forum Annual Meeting of the New Champions in Dalian, China 10-12 September 2009. © World Economic Forum.

• In March, China's Central Bank Governor Zhou Xiaochuan sparked controversy when he proposed that the International Monetary Fund create a new reserve currency - a proposal with enormous implications across Asia, which holds nearly US$ 4 trillion in foreign currency.

"I strongly supported the proposal made by Governor Zhou," said Yu Yongding, Senior Fellow, Institute of World Economics and Politics, Chinese Academy of Social Sciences (CASS), People's Republic of China and member of the Forum's Global Agenda Council on International Monetary Systems.

However, panelists agreed that the creation of a new global currency to replace the dollar and other sovereign currencies was not politically viable.

The overwhelming problems facing the Asian and US economies are not based on currency doubts. "Don't kid yourself. This crisis is not about currency problems. This problem is about the failures of policies," said Stephen S. Roach, Chairman, Asia, Morgan Stanley, Hong Kong. "We've had central banks that have just gone along for the ride, driven by ideologies, driven by politics."

Photo: Aron Cramer, President and Chief Executive Officer, Business for Social Responsibility (BSR), speaks during the Global Redesign Series -- What Is the Basis of a New Social Compact? session at The World Economic Forum Annual Meeting of the New Champions in Dalian, China 10-12 September 2009. © World Economic Forum.

Photo: Participants captured during the Dalian WorkSpace 2009 at the World Economic Forum's Annual Meeting of the New Champions in Dalian, China 10-12 September 2009. © World Economic Forum.

Photo: Zhu Min, Group Executive Vice-President, Bank of China, laughs during The Global Economic Outlook session at The World Economic Forum Annual Meeting of the New Champions in Dalian, China 10-12 September 2009. © World Economic Forum.

For the global financial system to steady itself, the US must increase exports and Asian economies, China's in particular, must do much more to reorient their growth away from external demand towards domestic consumption. "The most important thing for China is to speed up structural reform," agreed Yu.

When polled informally, participants preferred the yuan over the dollar as an investment but few believed it would replace the dollar as the global reserve. Among the panelists, only Oki Matsumoto, Founder and Chief Executive Officer of Japan's Monex Group, was mildly bullish on the dollar.

The World Economic Forum is an independent international organization committed to improving the state of the world by engaging leaders in partnerships to shape global, regional and industry agendas.

Source: World Economic Forum

|GlobalGiants.com|

Edited & Posted by the Editor | 3:55 AM | View the original post

September 8, 2009

World Economic Forum's Global Competitiveness Rankings: Switzerland Replaces United States at the Top

• Switzerland leads the rankings of the World Economic Forum's Global Competitiveness Report 2009-2010.

• The United States falls to second place, with weaker financial markets and less macroeconomic stability.

• Singapore moves up to third; Brazil, China and India also post improvements.

Photo: COLOGNY, SWITZERLAND - Cover of the World Economic Forum's The Global Competitiveness Report 2009-2010. © World Economic Forum.

• Download the full Report (PDF)

• Get the Highlights of the Report (PDF)

Switzerland tops the overall ranking in The Global Competitiveness Report 2009-2010, released today (September 8, 2009) by the World Economic Forum ahead of its Annual Meeting of the New Champions 2009 in Dalian, People's Republic of China.

The United States falls one place to second position, with weakening in its financial markets and macroeconomic stability. Singapore, Sweden and Denmark round out the top five. European economies continue to prevail in the top 10 with Finland, Germany and the Netherlands following suit. The United Kingdom, while remaining very competitive, has continued its fall from last year, moving down one more place this year to 13th, mainly attributable to continuing weakening of its financial markets.

Photo: People exit the World Expo Center at the World Economic Forum's Inaugural Meeting of the New Champions in Dalian, China on 5 September 2007. (Handout Photo/World Economic Forum/Doug Kanter).

The People's Republic of China continues to lead the way among large developing economies, improving by one place this year, solidifying its position among the top 30. Among the three other large BRIC economies, Brazil and India also improve, while Russia falls by 12 places. Several Asian economies perform strongly with Japan, Hong Kong SAR, Republic of Korea and Taiwan, China also in the top 20. In Latin America, Chile is the highest ranked country, followed by Costa Rica and Brazil.

A number of countries in the Middle East and North Africa region are in the upper half of the rankings, led by Qatar, United Arab Emirates, Israel, Saudi Arabia, Bahrain, Kuwait and Tunisia, with particular improvements noted in the Gulf States, which continue their upward trend of recent years. In sub-Saharan Africa, South Africa, Mauritius and Botswana feature in the top half of the rankings, with a number of other countries from the region measurably improving their competitiveness.

Photo: SEOUL, SOUTH KOREA - Koji Endo, Director, Equity Research, Credit Suisse Securities (Japan) Limited, Credit Suisse, Japan during the Joint Automotive and Logistics & Transport - World Economic Forum on East Asia 2009. © World Economic Forum. Photo by Oh Jaehyuk.