« U.S. News Media Group Launches Online University Directory | Main | UNESCO and Microsoft Announce Higher Education ICT Task Force for Long-Term Skills and Sustainable Development »

July 2, 2009

Companies Stockpiling Cash, Credit Access Still Tight

42% increase short-term holdings; most move to more conservative vehicles.

With little easing in access to credit, U.S. organizations are continuing to stockpile cash, according the Association for Financial Professionals' 2009 Liquidity Survey. Almost three-quarters (72%) of companies had increased or maintained their U.S. cash balances during the first part of 2009.

According to the new AFP survey, 42% of organizations increased their U.S. cash and short-term investment balances between December 2008 and May 2009, while 30% saw no significant change in short-term cash balances. More than a quarter (28%) of organizations saw their U.S. cash and short-term investment balances deteriorate over the six-month period. Organizations with non-investment grade ratings were more likely to have seen their cash and short-term investment balances shrink.

"Despite unprecedented government action, the lack of any significant thaw in short-term credit access is extremely troubling and many companies are reacting by stockpiling cash," said Jim Kaitz, President and CEO of AFP. "While, many organizations with their strong cash positions will be well-positioned once the economy begins to improve, overall economic conditions will not improve until organizations can begin using their cash in activities that foster growth."

The fourth annual AFP 2009 Liquidity Survey was underwritten by The Bank of New York Mellon.

Despite reports of an easing in the corporate credit markets, over half (59%) of respondents indicated that their organizations' access to short-term credit had not changed significantly since the beginning of 2009. A larger percentage of organizations reported that credit was less available (27%) than those who indicated that credit access had improved (14%). Two-thirds expect their access to short-term credit to remain the same over the next year.

Overall, only one-quarter (27%) of organizations expect to decrease their U.S. short-term cash and investments balances over the next year.

"The turbulence of the present period has had no small impact on the liquidity needs and practices of individuals and corporations worldwide," said Eric Kamback, the Bank of New York Mellon's CEO of Treasury Services. "The survey also revealed that many believe the tightening of available credit will persist in 2009, so conservative, safety-based investment strategies can be expected to continue."

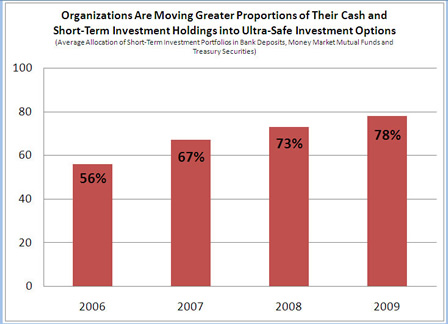

Organizations have moved to a more conservative investment strategy for their short-term balances and have reduced the number of vehicles they use for short-term investments, allocating 78% of their short-term investment balances to three safe and liquid vehicles: bank deposits, money market mutual funds and Treasury securities.

The use of commercial paper, separately managed accounts and auction-rate securities declined significantly over the past year. While investment policies allow for the use of four or more investment vehicles, on average, organizations use 1.6 investment vehicles compared to 2.4 options in 2008, the report says.

• AFP 2009 Liquidity Survey (PDF)

Source: Association for Financial Professionals

|GlobalGiants.com|

• GlobalGiants.Com is Member of the Boxxet Network The Exxchange (Finance and the Economy)

Edited & Posted by the Editor | 2:53 AM | Link to this Post